The markets both moved to the cycle high levels for the USD vs EUR and the JPY. The markets are now pricing in a near 30% chance of a 100 basis point hike at the July meeting.

For the EURUSD the low price just reached 0.99972 on my chart (bid side). That took out the low from yesterday at 0.99993. However, like yesterday, the price has seen a move back higher. The current price is trading at 1.00316. Looking at the hourly chart, the price of the EURUSD spiked higher just before release that saw the price stall right near the 100 hour MA at 1.0099. That was likely a liquidity spike. Others may have a different level.

What now?

Intraday.....Keep an eye on 1.0036 to 1.0039 area. That was near the close from yesterday. That is also near the 100 and 200 bar MA on the 5 minute chart (1.0035 and 1.0039 respectively). The price has spiked up to 1.0053 , but has moved back down quickly. The current price is at 1.0015 as I type in volatile trading. Of course on the downside the parity level is key. The option induced buyers against the level could turn to sellers if the parity level is breached with more momentum. Be aware. There could be a run on a break.

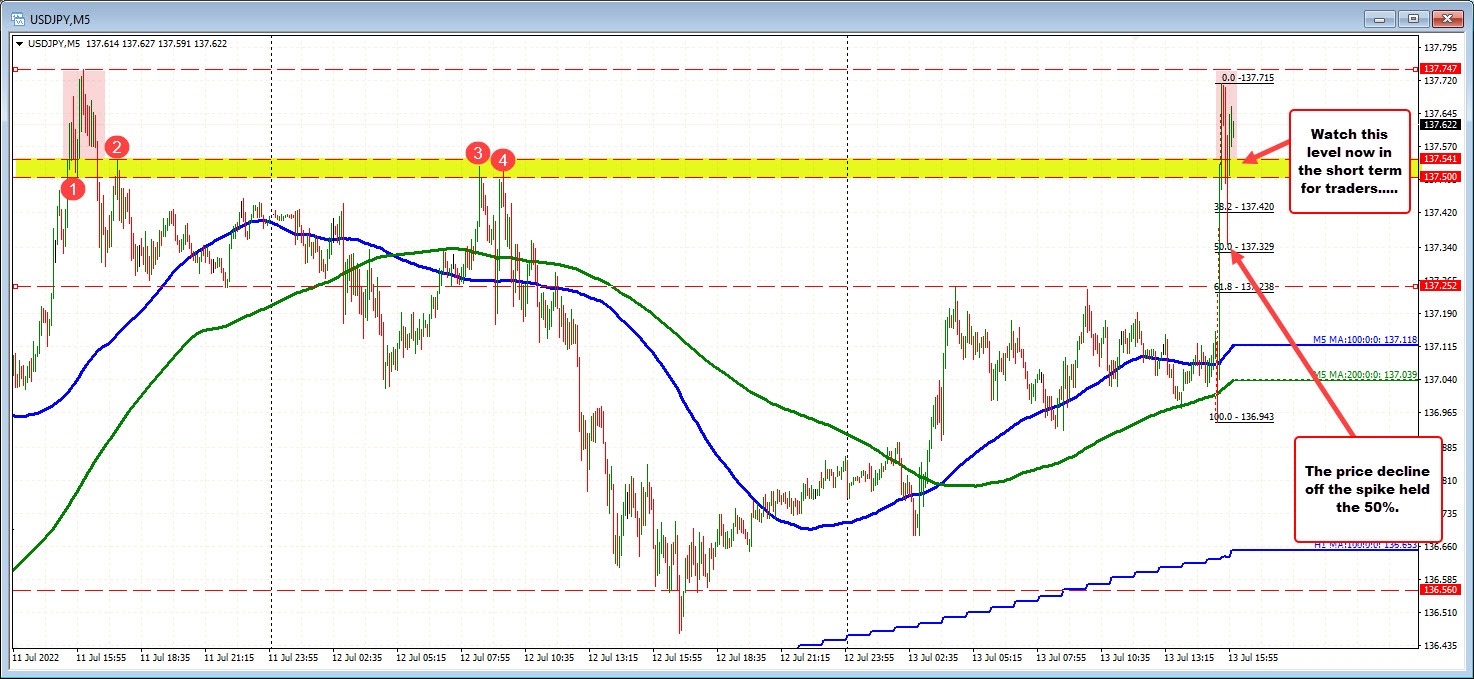

The USDJPY moved up to a high of 137.715. That was just short of the high from Monday at 137.747 (highest level since September 1998). The correction off the high came down to 137.349. That was just above the 50% of the move higher since the data release at 137.329. The price has moved back higher off that low and currently is trading back above a swing area between 137.50 to 137.54. In the short term, as the markets settle a bit, that area is trying to hold intraday support.

Volatility persists.. but so far the extremes in the EURUSD and the USDJPY are so far holding. Can that continue? Watch the shorter term clues.

IN the premarket for US stocks, the futures are implying an ugly open.

- Dow -274 points

- S&P -45 points

- Nasdaq -200 points

In the debt market:

- 2 year 3.17%, up 11.8 basis points

- 10 year 3.023% up 4.8 basis points

- 30 year 3.18%, +2.8 basis points

The big debate is ongoing. The markets are once again debating the idea that the peak is in. We have heard that story before and look where we are at?

The stocks are not waiting to see the whites of the "worst is over eyes". They are moving lower, but the forex market is showing some restraint to the move higher so far. IN addition to the EURUSD and USDJPY holding the extremes (more or less), other pairs like the

- GBPUSD is above the lows from yesterday.

- The USDCHF rallied but is below the close from yesterday.

- The USDCAD has come back down ahead of an expected 75 basis point hike at 10 AM ET after extending briefly above the recent highs from July 7, July 11 and July 12 at 1.3051 to 1.30548.

- The AUDUSD is above the lows for the week at 0.6710 to 0.6714. The low reached 0.67252

- The NZDUSD is an exception as it reached a new cycle low below 0.6096 to a low of 0.6080, but trades back above 0.6100. The RBNZ raised rates by 50 basis points today as expected but its currency continues to be under pressure.