The major European indices are closing mostly lower for the second consecutive day (Italy's FTSE MIB is the exception). A snapshot of the provisional closes shows:

- German DAX, -0.3%

- France's CAC -0.15%

- UK's FTSE 100 -0.21%

- Spain's Ibex, -0.9%

- Italy's FTSE MIB +0.1%

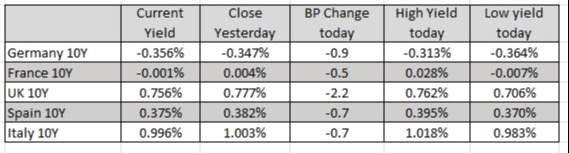

In the European debt market, the benchmark 10 year yields are all trading lower modest declines. France 10 year is back near parity at -0.001% after moving above and below the level in trading today.

In other markets as London/European traders look to exit:

- Spot gold is trading down seven dollars or -0.39% at $1775.84.

- Spot silver is trading down $0.40 or -1.79% at $22

- WTI crude oil futures are trading at $71.70. That's down from $72.36 at the settled price yesterday

- Bitcoin has one lower with the price trading at $48,760.22. It was trading near $50,600 at the 5 PM ET yesterday

In the US stock market, the major indices he are lower with the NASDAQ index leading the declines:

- Dow industrial average -24.18 points or -0.07% at 35,731

- S&P index -13 points or -0.28% at 4688.21

- NASDAQ index -100 points or -0.64% at 15686.10

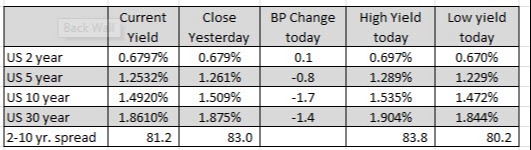

In the US debt market, yields are unchanged to lower. The two year yield is up 0.1 basis point. The 10 year is down -1.7 basis points. At 1 PM ET, the U.S. Treasury will auction of 30 year bonds. The current 30 year yield is trading down -1.4 basis points on the day.

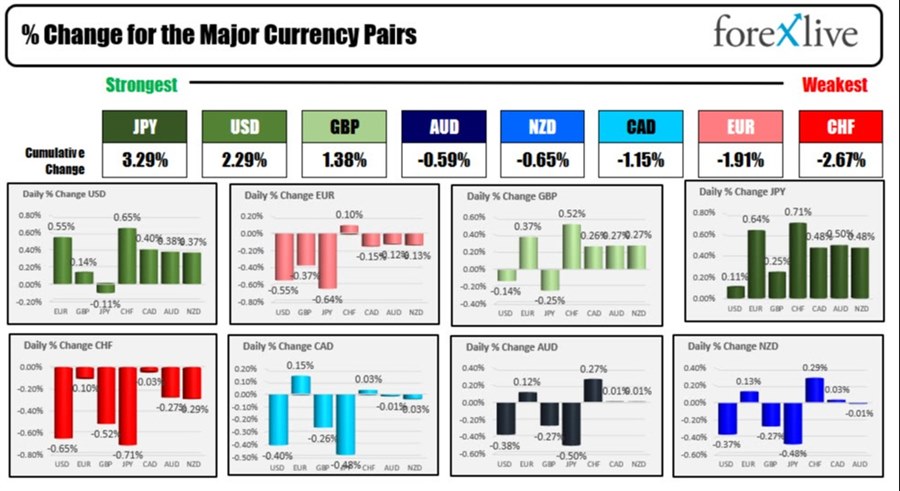

In the forex market, the JPY and the USD are the strongest of the majors, while the CHF and EUR are the weakest: