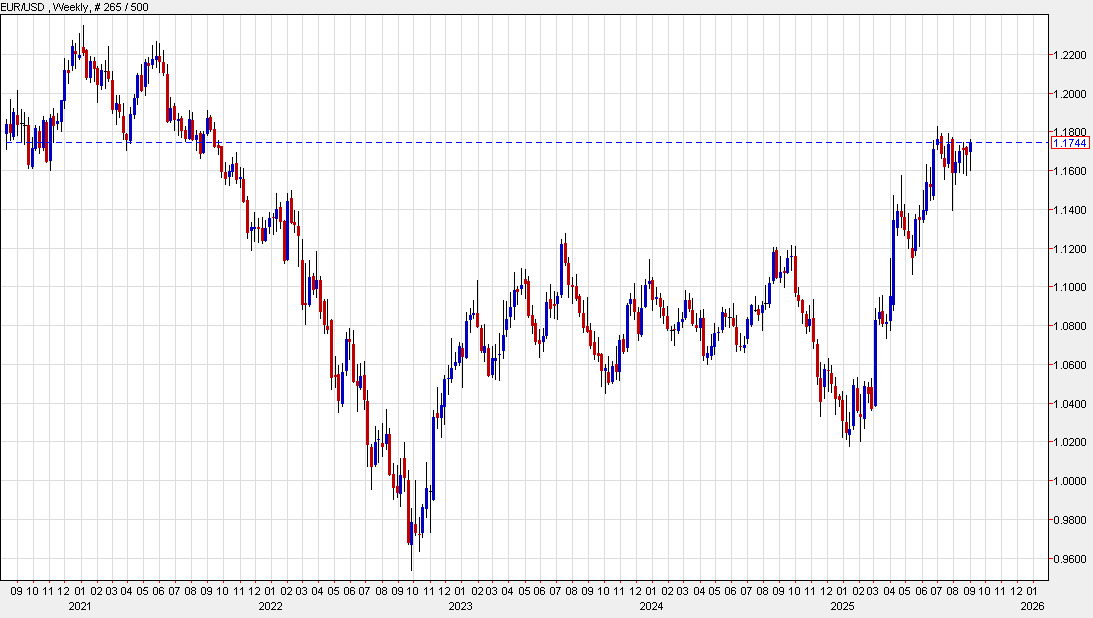

The euro has been one of the beneficiaries of a weakening US dollar following another soft non-farm payrolls report. It's up 96 pips to 1.1745 and touched as high as 1.1759. That's a fresh high since July 27 and looks like a breakout from the recent period of consolidation, particularly if it can close above the August highs.

If it can sustain some momentum it will have challenges at 1.1789 (July high) and 1.1830 (June high) before it can find some clear air but that dip down to 1.14 is now looking something like an inverted head and shoulders that targets +1.20.

On the fundamental side, the ECB is set to meet this month and hold rates. European economic data has also been surprising to the upside while US data has surprised to the downside. The market could soon focus on the contrasting monetary policy outlooks and -- the optimists at least -- may believe that Europe is recovering from the cycle bottom. And to be fair, what's happening in Italy is impressive with unemployment at generational lows.