Fed chairs comments spur reversals

The Fed chair pivoted by retiring "transitory" from inflation.

The impact as seen the US stocks move lower (with the Nasdaq moving from positive to down -1.24%). The USD has reversed higher, and the yields have come off low levels.

A snapshot of the stock market currently shows:

- Dow Jones -500 points or -1.43% at 34635

- S&P index -63 points or -1.36% at 4591.50

- NASDAQ index -209 points or -1.32% at 15573.90

- Russell 2000-40.318 points or -1.8% at 2201.65

in the US debt market:

- 2 year is up 20.537% after trading as low as 0.441%

- 5year 1.181% after trading as low as 1.070%

- 10 year 1.475% after trading as low as 1.412%

- 30 year 1.815% after trading as low as 1.795%

IN other markets:

- Spot gold has turned back negative and currently trades $-6.50 or -0.36% at $1778. It traded as high as $1808.72 before reversing course

- WTI crude oil futures are still down $-2.78 at $67.24 but off the lows of $66.54

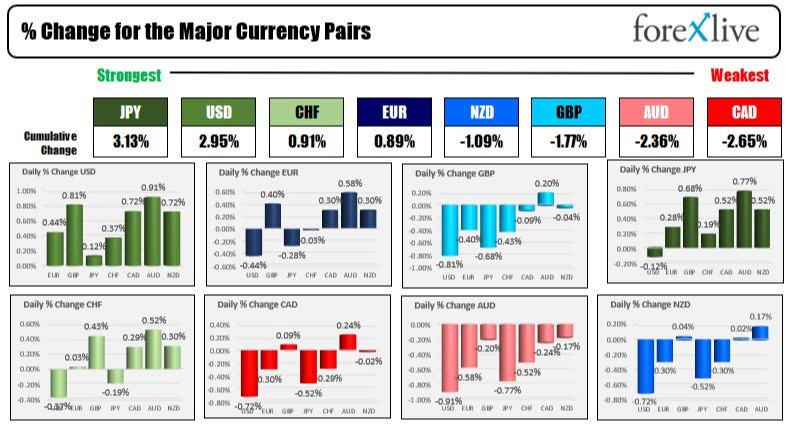

The US dollar went from the weakest currencies to one of the strongest. The JPY is the strongest followed by the USD. The CAD and AUD are the weakest.