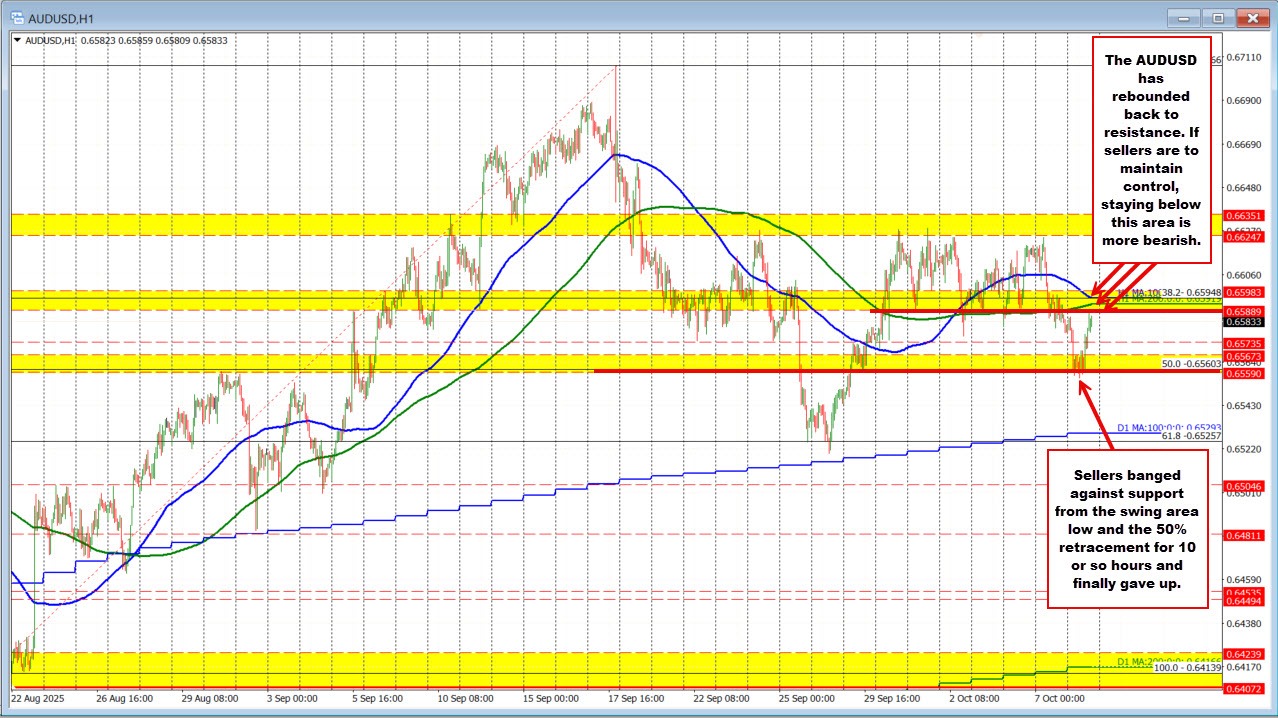

The AUDUSD moved lower in tandem with the NZDUSD after the RBNZ delivered a larger-than-expected 50 basis point rate cut in the Asian Pacific session. The selling pressure took the pair down toward the 50% retracement of the move up from the August 21 low at 0.6560, which aligned with the low of a swing area at 0.6559. The low price reached 0.6556.

With momentum fading and the price waffling up and down between 0.6556 and 0.6569, the sellers gave up, and the buyers started to take back control.

Over the past five hours of trading, the tide has seen buying momentum push the pair higher as sellers gave up on pressing lower. That rebound has now carried AUDUSD to a test of 0.6588, just shy of the key technical barrier set by the 200-hour moving average at 0.6592 and the 100-hour moving average at 0.65948.

These two moving averages now represent the critical barometer for buyers and sellers.

For sellers, the level provides a well-defined ceiling to lean against in order to keep the bias in their favor.

For buyers, a break above both would be a strong technical signal that control is shifting, opening the door to further upside momentum. Until that happens, sellers maintain the edge, but the risk is clear: a decisive move above the 100- and 200-hour moving averages would tip the balance back toward the bulls.