The Australian dollar has been the laggard in the FX market since the start of November but it turned around this week and was the top-performing G10 currency.

Is it a dead-cat bounce or the start of something more?

The AUD/JPY chart has some positive signs even as the fundamental risks remain high. For starters, the low last week was above the Sept and Aug lows to maintain a series of higher lows. That leaves the uptrend since the pandemic bottom intact. We've also on track for a weekly close above the prior week's high.

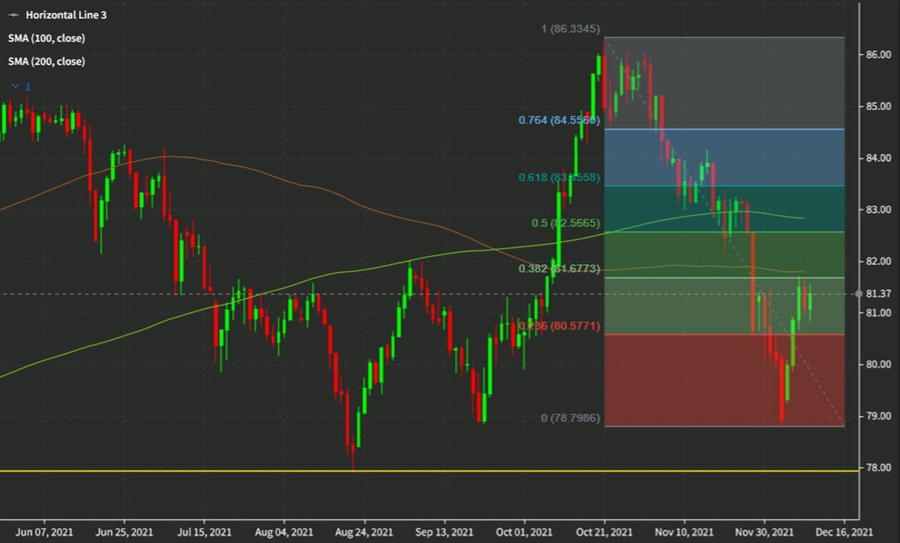

The daily chart presents a different concern, with this week's rebound failing at the 100-day moving average repeatedly and the 200-day tying nicely with the 50-61.8% retacement of the drop since Oct 21.

AUD/JPY daily

On the fundamental side, the RBA certainly helped to propel AUD/JPY to the top of the FX chart as they brushed off covid and focused on better business investment and household spending.

Despite that, omicron is a real risk and a particular risk to China's covid-zero policy. It could lead to shutdowns there and port disruptions. Any slowdown in China's growth is a problem for Australia. On the flipside, the RRR cut this week was also good for AUD and might show that China is taking steps to ease ahead of adjusting its covid policy. After all, they surely know they can't keep covid back forever.

All this is within the narrowing window towards year end. Next week is the last proper week of trading of 2021 and that should start to cap volatility, though that hasn't been true in recent years. I would put the 200-dma as the best AUD/JPY can achieve before year end, while the downside should be contained by 0.7900 baring another omicron freakout.