U.S. major indices have risen in five of the last six trading days, lifting many large-cap bellwether names into more constructive technical positions. However, two key market leaders are still struggling from a technical standpoint, and one remains neutral. Both Microsoft and Nvidia continue to trade below their 100-hour and 200-hour moving averages, and each attempted—but failed—to break above the 100-hour MA in today’s session.

This raises an important question: Can the broader market continue its year-end rally without participation from these two heavyweight stocks? If the answer is no, then the 100-hour and 200-hour MAs in both Microsoft and Nvidia become critical bias and trading guides—not just for those names individually, but for the overall market tone.

Below is the technical summary for Microsoft, Nvidia, Apple, Alphabet, and Meta. Apple and Alphabet remain firmly bullish, while Meta sits in a more neutral, short-term posture.

Microsoft. Bearish.

The price of MSFT is off the low at $464.89 reached on Tuesday, November 25, but is having some problem near a key swing area and the 100 hour moving average near $492. The high price today did extend to $493.50 just above that level, but has since rotated back below that moving average level (and swing level - see red numbered circles) and currently trades at $490.29. A sustained move above the $492 area - and then the 200 hour MA at $505 (green line) is needed to increase the bullish bias. Absent that and the sellers are still more in control.

Nvidia. Bearish.

Nvidia reached to a low of $169.55 last week (November 25), but has since extended up to the 100 hour moving average and briefly above that level during today's trade. The 100 hour moving average comes in at $184.07. The high price reached $185.66. However, like MSFT, the momentum could not be sustained, and the current price is back below that level at $181.29.The price of Nvidia needs to get and stay above the 100 hour moving average - and then the 200 hour mA at $189.34 - to give the buyers more comfort/control. Absent that and they sellers are still more in control.

Now there are some bright spots technically too:

Apple: Bullish.

Apple is comfortably above both its 100 and 200 hour MAs and trading at new record levels today. The price is at $285.58 up 0.87%. The 100 hour MA is at $274.14 and the 200 hour moving averages at $270.80. The price would need to get below those levels to give the sellers more control.

Alphabet: Bullish

Alphabet is trading at $316.72 up $2 or 0.64%. The price is also above its 100 hour MA at $299.70 (and moving higher) and the 200 hour MA at $286.75 (and moving higher). However, the price is also below the high from last week (all time high) at $329.30. There is a gap ahead of the 100 hour moving average between $306.42 and $309.60. Moving below that gap area would give the sellers some hope with a move back below the 100 and 200 hour MAs needed to tilt the bias more to the downside.

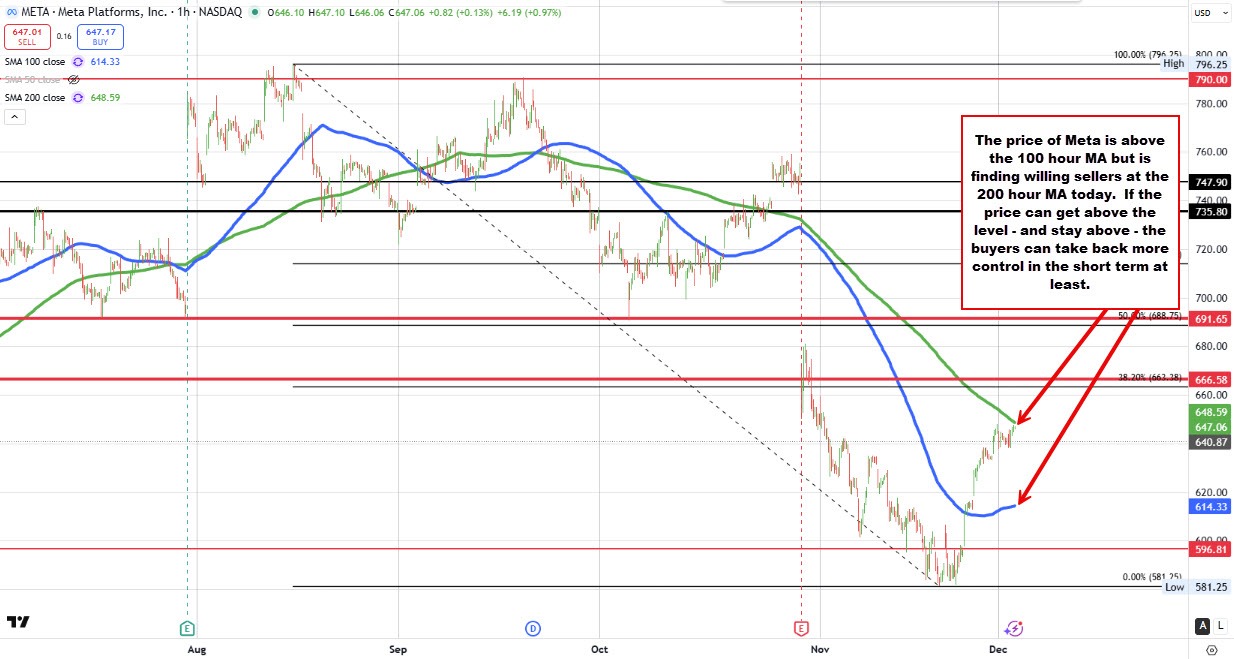

Meta: Neutral

Meta is mixed. While the current price is at $647.10 (up $6.25 or 0.90%) and above its 100 hour moving average at $614.33 (blue line), it remains below its 200 hour moving average at $648.59 (green line). The high price today stalled just ahead of that area at $647.67. To increase the bullish bias, the price would need to get and stay above that 200 hour moving average. Conversely, if the price cannot get above that level the risk is for a rotation back down toward the 100 hour moving average at $614.33 and we will then monitor for a break - increasing the bearish bias.