AppLovin (APP) dives on headline shock - what investors need to know today

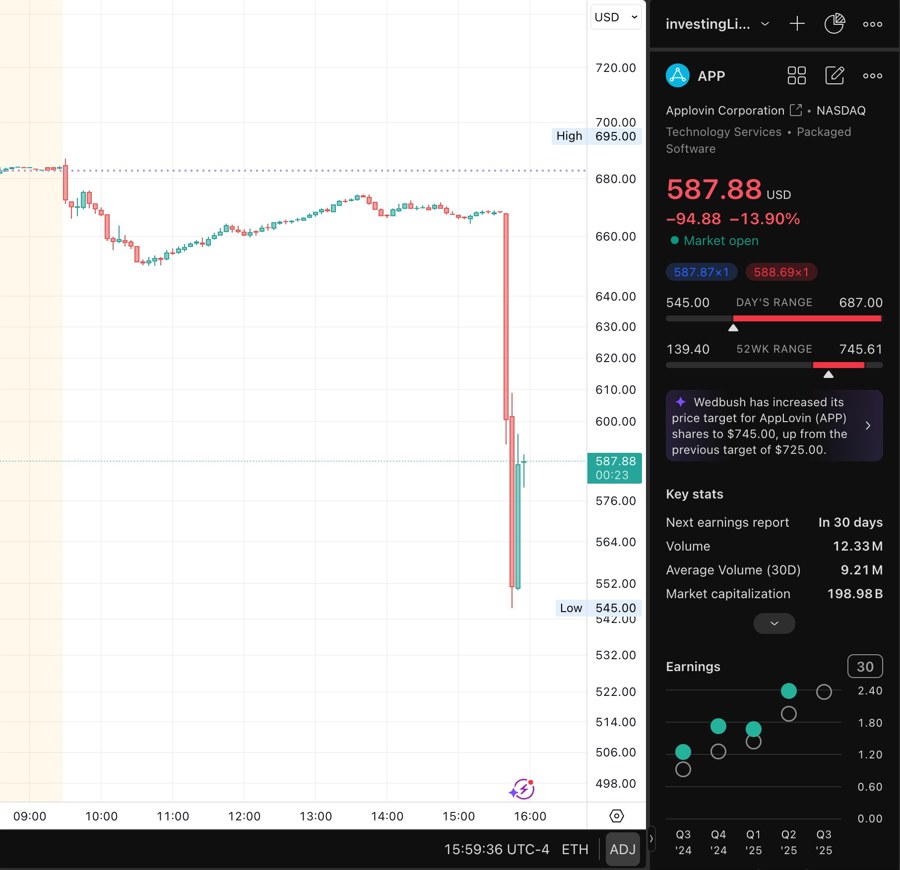

Move - At 15:40 ET, APP fell off a cliff on the 5-minute chart, dropping more than 10 percent in the first bar of the slide and extending losses intraday.

What happened at AppLovin

A Bloomberg report said the SEC has been probing AppLovin’s data-collection practices. The headline hit the tape mid-afternoon and the stock sold hard as traders de-risked. Reuters quickly echoed the story and noted the move in the shares. (Bloomberg)

Why AppLovin ain't getting too much love

Headline risk stacked on a crowded long - APP was one of the S&P 500’s top winners last quarter after its September inclusion, with several street targets lifted in recent days. That kind of positioning can flip quickly on negative regulatory news. (Barron's)

Existing overhang - Earlier in the year, short sellers attacked APP over data use and business quality. Even if disputed, that history makes the tape extra sensitive to any enforcement story. (Investopedia)

Rising short interest into Q4 - Recent reporting flagged shorts returning after a big squeeze, which can amplify intraday volatility when a fresh catalyst hits. (Bloomberg)

The market’s read

Regulatory uncertainty - An SEC probe does not equal charges, but it increases headline risk and can slow new advertiser onboarding if counterparties get cautious.

Valuation reset risk - After a powerful run, even a temporary growth wobble or higher perceived legal risk can drive a quick re-rating.

What to watch next for APP stock

Company response - Look for an 8-K or IR statement that clarifies scope and timing of any SEC contact. No new filing was visible at the time of writing. (Applovin)

Follow-up reporting - Details matter: informal inquiry vs formal investigation, focus on specific products, any remedial steps. (Bloomberg)

Advertiser sentiment - Any signs of spend pauses in e-commerce client cohorts that powered the bull case. Recent research highlighted big expectations for that channel. (Barron's)

App stock for traders: Key trading levels and risk markers

Intraday low zone - Monitor the first panic low from today’s flush for acceptance or rejection on a retest.

Prior breakout area - If price sustains below the late September breakout base, risk of a deeper re-rating increases.

Volume profile - Elevated volume on the selloff suggests a new reference area for supply. Bulls will want to see absorption on any retest.

Longer-term context for investors

The secular bull case rests on APP’s ad-tech stack scaling beyond gaming into e-commerce. Street narratives have been very positive, which raises the bar for execution and clean compliance optics. (Barron's)

Prior short reports and litigation chatter are part of the backdrop. Days like today remind that headline risk is a core factor in ad-tech. (Investopedia)

My take and what may come next for APP stock

Today’s move looks like a headline shock amplified by positioning. Until there is clarity on the SEC angle, expect higher volatility and a headline-driven tape. Short term traders should respect levels. Medium term investors should anchor decisions to two questions: 1) does the news change advertiser behavior, and 2) does it alter the growth and margin path that supported recent target hikes.

Last but not least, the stock did not stage any impressive rebound, which implies the news may be real and perceived as significant enough for holders to be selling.

Decision support only - not investment advice. Trade at your own risk.