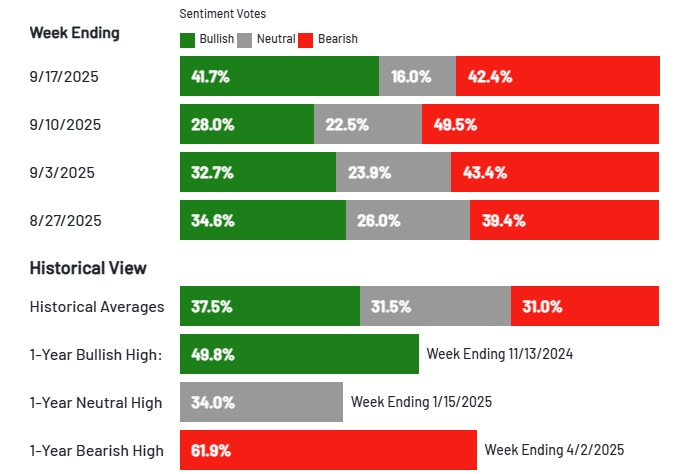

The latest survey from the American Association of Individual Investors is something of a red flag for equity markets. Sentiment in the survey jumped to jumped to 41.7% from 28.0%. That's the biggest one-week surge since January and also the highest reading since the July 3rd peak at 45.0%, which was the high of the year.

The number isn't a raging sell signal but it's above the long-term average of 37.5% for the first time in 7 weeks.

Notably, there is a big divide in the market with bearish sentiment at 42.4% and still above the long-term 31.0% average.

As for the bullish side, the all-time high of 75% came right at the peak of the dot-com bubble on January 6, 2000. More recently, the 2021 peak was 56.9% in early April that year and it wasn't until December of that year that the market peaked and rolled over.

Another interim peak was in July 2024 when it hit 52.7% bullish and that was followed in very short order by a 9.7% correction that was halted when the Fed began to signal rate cuts.

In short, I wouldn't be too worried yet but keep an eye on this indicator if it gets above 50% and certainly above 55%.