From the Intel Q2 2025 Earnings, in summary

Revenue Beat, EPS Miss:

Intel reported $12.9 billion in Q2 revenue (flat YoY), beating estimates ($12B). However, it posted an adjusted loss of $0.10 per share, missing expectations of a $0.01 gain.

Heavy Restructuring Costs:

$1.9 billion in restructuring charges from ~15% workforce cuts (excluded from adjusted EPS)

$800 million in impairment charges and $200 million in other one-time costs did impact adjusted EPS by 20 cents

GAAP net loss: $2.9 billion

Business Segment Results:

Client computing: $7.9B (vs. $7.4B expected)

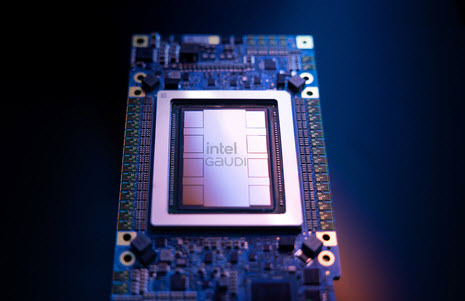

Data center & AI: $3.9B (vs. $3.6B expected)

Q3 Guidance:

Revenue: $12.6B–$13.6B (midpoint above $12.7B consensus)

Adjusted EPS: break-even (vs. 4 cents expected)

Dow Jones / Market Watch (gated) have gathered analyst responses. In (brief) summary:

- Bernstein: Strategy is more important than results; structural headwinds remain. PC business may benefit from tariffs, but it's not a long-term growth story.

- BofA: Intel's new chip process (18A) and enterprise refresh cycle may offer upside. However, competition from AMD and Nvidia remains intense, and Intel still lacks strong AI accelerators.