Fundamental Overview

The Nasdaq remains supported by the current US government shutdown as it keeps bearish risks away. In fact, the delay of key US data like the NFP is keeping monetary policy expectations steady and doesn’t give the Fed members much to work with.

As long as the Fed continues to cut interest rates and keeps a dovish reaction function, the stock market will remain skewed to the upside on steady growth expectations. What could trigger a bigger pullback is a hawkish repricing in the current interest rates expectations. That will require strong labour market data though, or clear inflation re-acceleration (will likely need Core PCE above 3%).

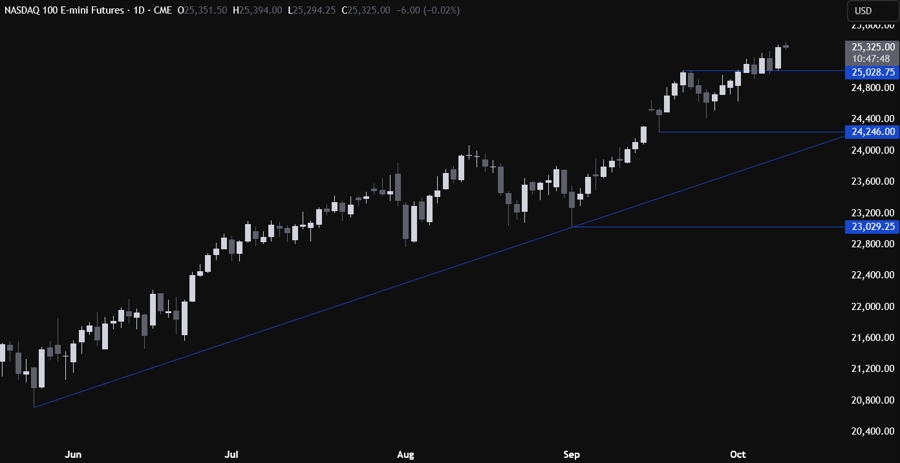

Nasdaq Technical Analysis – Daily Timeframe

On the daily chart, we can see that the Nasdaq bounced around the previous all-time high at the 25,000 level which acted as support. If we get another pullback into the support, we can expect the buyers to step in again with a defined risk below the support to keep pushing into new highs. The sellers, on the other hand, will want to see the price breaking lower to target a deeper pullback into the 24,400 level next.

Nasdaq Technical Analysis – 4 hour Timeframe

On the 4 hour chart, we can see that we have a minor upward trendline defining the bullish momentum. If we get a pullback, we can expect the buyers to lean on the trendline with a defined risk below it to keep pushing into new highs, while the sellers will look for a break lower to pile in for a drop into the 24,400 level next.

Nasdaq Technical Analysis – 1 hour Timeframe

On the 1 hour chart, we can see that we have a minor support zone around the 25,260 level. The buyers will likely step in there with a defined risk below the support to position for a rally into new highs. The sellers, on the other hand, will look for a break lower to target a drop into the 25,000 support. If the momentum remains strong, we can expect the buyers to pile in on a break above the counter-trendline around the 25,350 level. The red lines define the average daily range for today.

Upcoming Catalysts

Today we have Fed Chair Powell speaking, while tomorrow we conclude the week with the University of Michigan consumer sentiment report.