Major US stock indices are closing lower. The NASDAQ is down for the 3rd consecutive day. The Dow industrial average and the S&P indices are down for the 2nd consecutive day.

A snapshot of the closing levels shows:

- Dow industrial average down 41.31 points or -0.09% at 48416.74

- S&P index -10.89 points or -0.16% at 6816.52

- NASDAQ index -137.76 points or -0.59% at 23057.41

- Russell 2000-20.79 points or -0.81% at 2530.66.

Broadcom shares continued its move sharply lower today, extending recent weakness despite the company delivering better-than-expected earnings and revenue after the close on Thursday last week. Broadcom reported EPS of $1.95 versus $1.86 expected, with revenue at $18.02 billion versus $17.47 billion expected, and also issued stronger-than-expected guidance. However, the stock had been priced for near-perfection, and investors quickly shifted focus to slightly lower margins, which fell by a few percentage points and raised concerns about profitability trends.

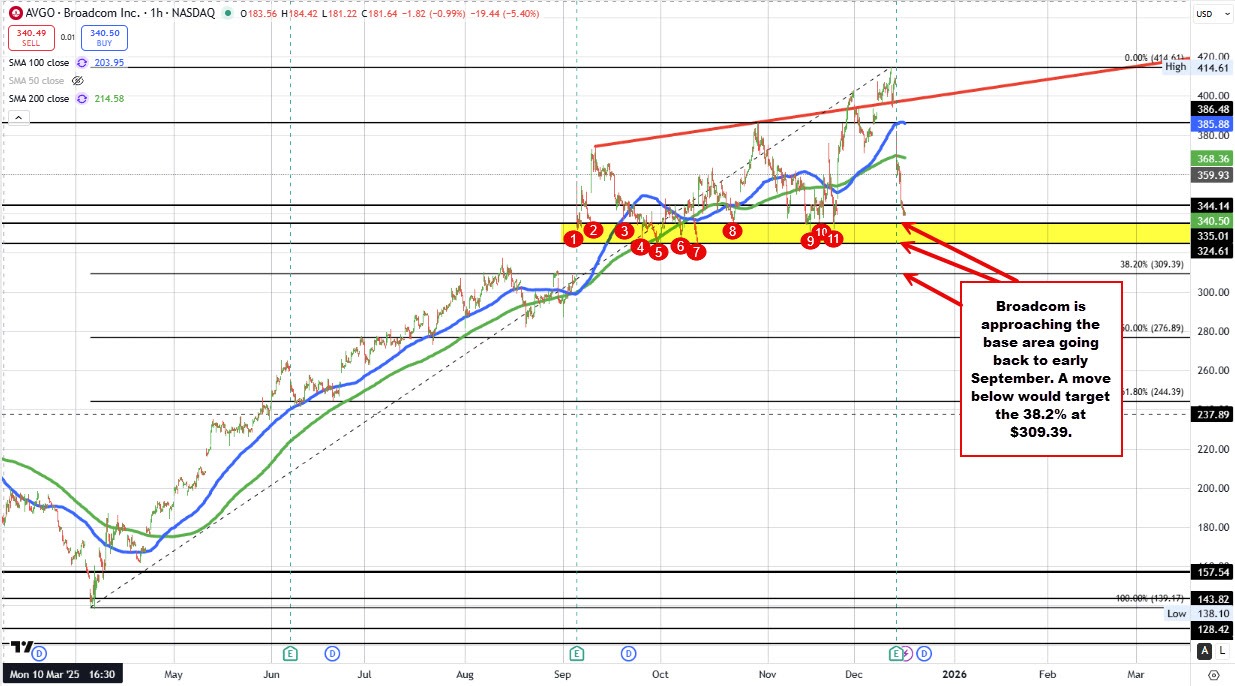

From a market perspective, the reaction highlights a broader theme in the NASDAQ, where high-multiple stocks are struggling to absorb even modest disappointments. Broadcom shares are now down roughly 18.25% from recent all-time highs from last Wednesday, with sellers firmly in control. Technically, the stock has broken below the 100 and 200 hour MAs at $385 and $368 respectively, and is approaching a swing area floor that extends back to early September between $324.61 and $335.01 (see red numbered circles on the chart below). Below that the 38.2% retracement of the 2025 trading range comes in at $309.39.

Bottom line: Broadcom’s results were fundamentally strong, but valuation sensitivity and margin concerns outweighed the beat, making the stock a focal point for the broader tech-led pullback.

Shares of the Strategy (formally Micro Strategy – MSTR) tumble -$14.37 or -8.14% at $162.08. The shares closed at its lowest level going back to the end of September 2024. The price bitcoin is down -2.88% today at $85,601.

Strategy (MSTR) is effectively a leveraged Bitcoin proxy. The company’s core software business is now secondary to its strategy of accumulating Bitcoin, largely financed through convertible debt and equity issuance. As a result, MSTR’s share price tends to amplify moves in Bitcoin—rising faster when BTC rallies and falling harder when BTC pulls back.

- The "Holdings" Numbers (Latest Data)

Total Bitcoin Held: ~660,624 BTC

Recent Purchase: Acquired 10,645 BTC for ~$980 million (Dec 8–14, 2025).

Current Market Value: With Bitcoin fluctuating near $92,000–$95,000, the total stack is valued at approximately $61 Billion.

2. "Strategy BE" (The Break-Even Analysis)

The "BE" or Break-Even point is the critical metric investors watch to see if MicroStrategy's leveraged bet is underwater.

Estimated Average Cost Basis: ~$74,696 per BTC.

Note: This average has crept up significantly as the company purchased aggressively throughout 2025 at prices above $80k and $90k.

The Safety Cushion:

Current BTC Price: ~$93,000

Break-Even Price: ~$74,696

Buffer: MicroStrategy is currently ~25% in the profit zone.

Risk Zone: If Bitcoin falls below $75k, the company’s "unrealized profit" vanishes, which could trigger a negative feedback loop for MSTR shareholders (though Michael Saylor has pledged never to sell).

Some of the major decliners today included:

Strategy (MSTR): -8.14%

Nebius NV (NBIS): -7.44%

Broadcom (AVGO): -5.61%

SoFi Technologies (SOFI): -5.28%

Arm Holdings (ARM): -5.00%

Grayscale Bitcoin Trust (GBTC): -4.90%

Uber Technologies (UBER): -3.93%

Robinhood Markets (HOOD): -3.62%

Alibaba ADR (BABA): -3.57%

Zoom Video (ZM): -3.32%

CrowdStrike Holdings (CRWD): -3.38%

Salesforce (CRM): -3.17%