After the selling yesterday, we're starting to see signs of caution again in markets today. Risk appetite held steadier early in the day but is now beginning to turn once more. It's clear that there's some modest de-risking taking place across broader markets this week, with Bitcoin once again set to be put to the test of the $100,000 mark as well.

As for stocks, we're seeing things turn lower now in European morning trade. The DAX is down 0.6% and CAC 40 down 0.3% on the day. This comes as S&P 500 futures are also dropping, seen down 0.1%, with Nasdaq futures lower by 0.2% currently.

For now, major currencies are keeping calmer but just be wary of the market situation in case we see things deepen again when Wall Street enters the fray.

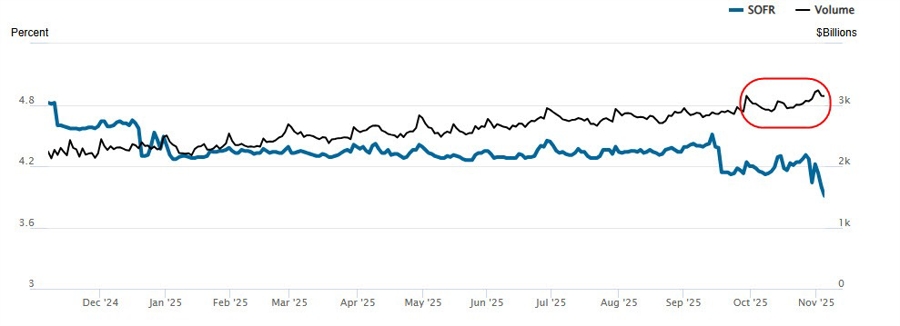

I'd hate to pin the negative mood on the US shutdown but it might be playing some part perhaps but not quite on the sentiment front. It's arguably a more technical thing with the shutdown impacting market liquidity. One evidence of such strain is in the SOFR, which has been on the rise since the shutdown began:

It indicates that borrowing costs have risen since the shutdown started, suggesting that banks might be facing shortage of funds amid the liquidity drain mentioned. That as the Treasury General Account (TGA) continues to siphon money in but is unable to release funds because most government departments are closed. Just some food for thought.