FUNDAMENTAL OVERVIEW

The S&P 500 continues to print new all-time highs as risk sentiment remains positive amid lower geopolitical tensions, a neutral Fed and improving US growth. These drivers are supportive for the stock market and will likely keep underpinning prices to new record highs unless we get a hawkish repricing in the next couple of weeks.

In fact, we are now entering a pivotal month when we will get new tier one data including the US NFP and CPI reports. What could weigh on the market in the short-term is a hawkish repricing in interest rate expectations caused by strong data.

Traders are pricing in 48 bps of easing by year-end compared to 25 bps projected by the Fed. In case we get strong data, the market will need to reprice that at least to get in line with the Fed’s view. If the data continues to surprise to the upside or comes out too hot, then we could see all the rate cut bets getting quickly trimmed.

Today we have the US Jobless Claims data on the agenda. Very strong figures could weigh in the short-term but it will likely just offer a dip-buying opportunity.

In the bigger picture, as long as inflation continues to slowly head towards target, the stock market should remain supported amid the Fed’s dovish reaction function. A quick deterioration in the labour market though could trigger growth fears and lead to a correction.

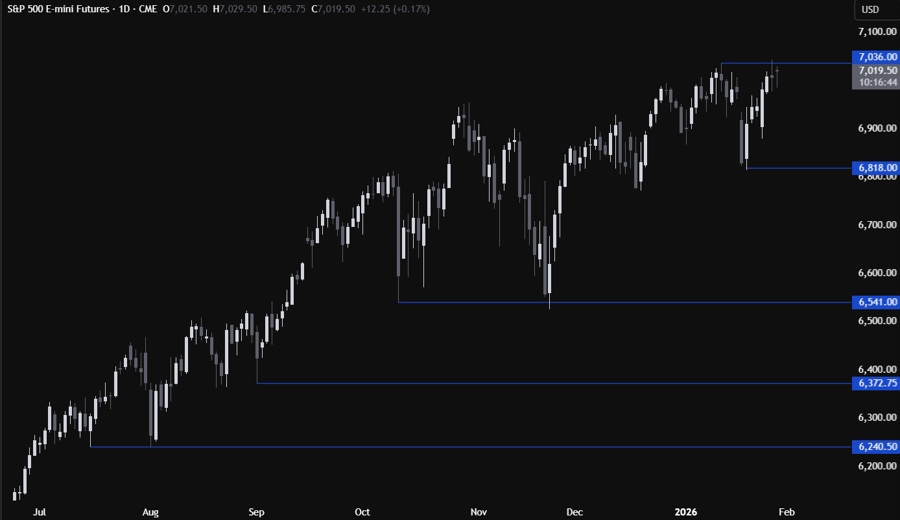

S&P 500 TECHNICAL ANALYSIS – DAILY TIMEFRAME

On the daily chart, we can see that the S&P 500 recently touched a new all-time high before pulling back a bit. The buyers will want to see a breakout to increase the bullish bets into new record highs. The sellers, on the other hand, will likely step in around these levels with a defined risk above the record high to position for a correction back into the 6818 level next.

S&P 500 TECHNICAL ANALYSIS – 4 HOUR TIMEFRAME

On the 4 hour chart, we can see that we have an upward trendline defining the bullish momentum on this timeframe. From a risk management perspective, the buyers will have a better risk to reward setup around the trendline to keep pushing into new highs. The sellers, on the other hand, will want to see the price breaking lower to pile in for a drop into the 6880 level next.

S&P 500 TECHNICAL ANALYSIS – 1 HOUR TIMEFRAME

On the 1 hour chart, there’s not much we can add here as the buyers will either pile in on a break above the all-time high or wait for a pullback into the trendline, while the sellers will look for shorts around the record high and on a break below the trendline. The red lines define the average daily range for today.

UPCOMING CATALYSTS

Today we get the latest US Jobless Claims figures. Tomorrow, we conclude the week with the US PPI report.