Microsoft is widely (and rightly) seen as a defining company of the past 50 years. It's changed the world completely, is ubiquitous, highly profitable and among the most-valuable in the world.

People also forget that for a decade, it was a joke in the stock market.

The Steve Balmer era was a disaster and coincided with the resurrection of Apple by Steve Jobs. Balmer too over from Bill Gates on January 13, 2000 and remained CEO for 14 years. He was such a bad CEO that on the day he resigned shares jumped more than 7%, which was enough to boost Balmer's net worth rise by around $750 million.

He completely blew it on mobile and social.

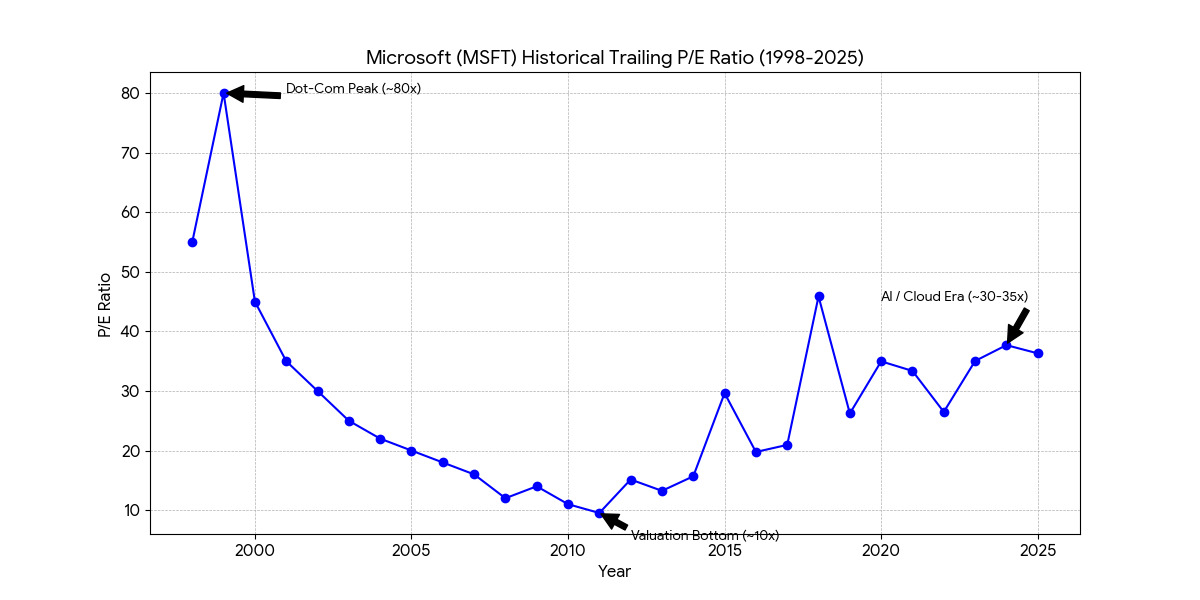

When the company was seen as dead money, the valuation of shares repeatedly fell below 10x trailing earnings.

It can happen again and it has at many times and in many companies.

I like MSFT, I can see it maintaining a dominant position for many years but multiple contraction happens when the market loses confidence in the narrative. From 2000 to 2023, Microsoft's share price was cut in half even as earnings doubled.

If AI upends the world, we may simply be a place where P/E ratios trade closer to 15x than 25x currently.

If we go back to 2019, the P/E multiple was 15.5x and the index was at 2800. Since then, earnings have risen 70% but the index has risen by 175%. If we were to go back to a 15.5x multiple, the S&P 500 would need to fall about 35% to 4200.

And if you really want a scare, remember that the index traded at 7.5x earnings in the late 1970s.

At the moment stocks are benefiting from decades of globalization, financialization, deregulation, peace and huge government deficits. One day the party will end.