A middling start for US stock markets has turned into a solid gain, with the S&P 500 up 0.25% to a record 6964. The Nasdaq is leading the way today, up 0.7% to 23718, which is still shy of November's record at just above 24,000.

The Russell 2000 has been the standout performer so far this year but it's trailing today at -0.1%.

The big-cap winner today is Intel, which is up 8% as it's embraced by meme-stock traders on the expectation that it's been deemed a 'winner' by the White House with the administration taking a 10% stake in the company. It's also a potential AI winner if it can figure out how to manufacture chips competitively again.

CarMax is in the silver medal posiotion today, up 5.2%. That rally hasn't come on any news Iv'e seen but today's ISM services number was good and that should translate into solid consumer spending. Treasury yields are also lower, which is a good sign for borrowing costs.

In third place is American Airlines. I've been touting airlines as an investment and Jeffries is out with an interesting report. The argue that the single "airline cycle" is dead. Instead, the industry is operating in two disconnected realities based on the customer base they serve. The report titled "K-Shaped Economy, K-Shaped Airline Strategies," argues that the airline industry has bifurcated into two distinct tracks, where wealthier consumers continue to spend while lower-income consumers pull back.

American isn't as 'premium' as Delta and United but it can claw into that segment while Spirit and other discount carriers will struggle to attach premium and business travellers.

Other top gainers today are Palo Alto Networks and Eli Lilly, both up about 4.5%.

A loser today is First Solar, which is down 9.7%. Yesterday, I noted the name as a potential winner if the US Supreme Court upholds tariffs. That it's falling suggests the market sees the Supreme Court ruling against tariffs.

I suggest reading the report: The Supreme Court scheduled Friday as an 'opinion day'. What's the trade

Another loser is Western Digital, which is down 9.5% after yesterday's memestock frenzy/short squeeze based on memory names.Seagate is also struggling.

Finally, energy names are lower and have largely given up the Venezuela gains aside from the refiners. A sober second thought is showing that it's going to be costly and difficult to get oil out of Venezuela any time soon.

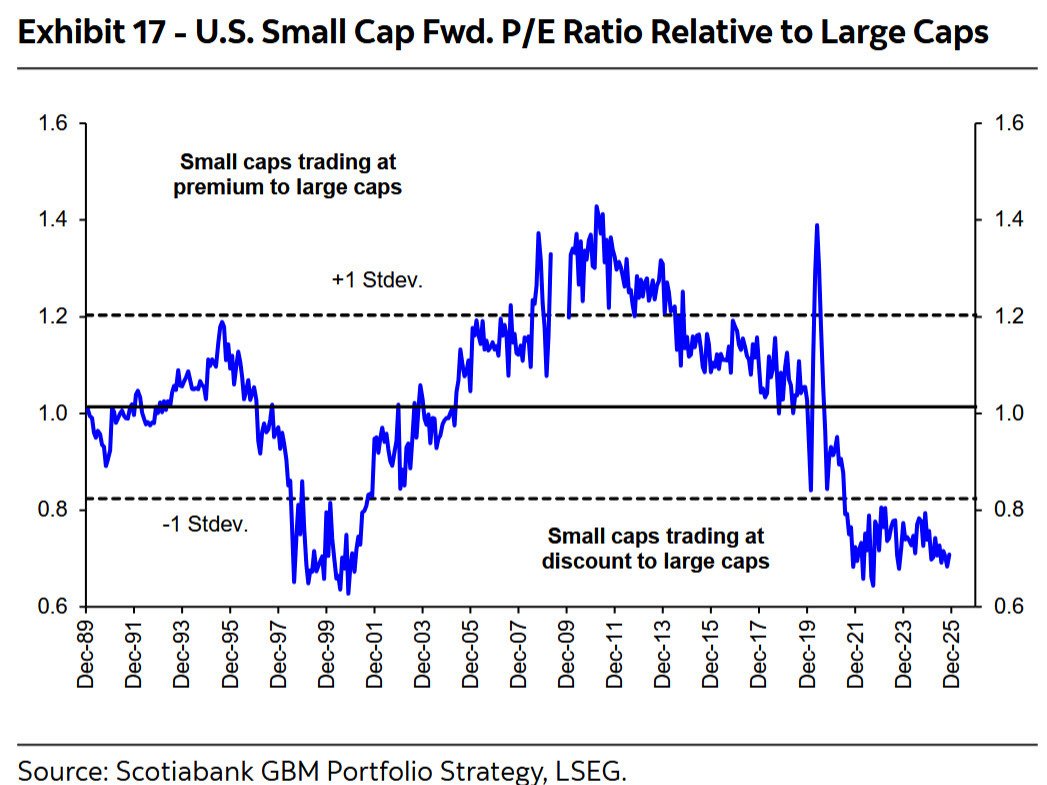

In terms of the small-cap outperformance story, here is a notable chart from Scotia: