Late last year, long-time tech investor and analyst Dan Niles said his best idea for 2026 was cash. So far, that's proven to be mostly correct as the Mag7 names have been struggling or uneven. On Friday, they got a lift but only Meta (+1.7%) and Alphabet (+7.1%) are higher on the year so far. Apple is the laggard, down 8%.

Niles now runs Niles Investment Management and warns in a post on twitter that the group's historical dominance is fraying. 2025 saw a notable divergence as five of the seven underperformed the S&P 500. Without a massive +65% gain from Alphabet, the group's average return would have lagged the broader index.

Niles points to a "distinct shift" from concentration to diversification and from large-cap to small-cap that began in late October 2025, as investors start distinguishing between true AI winners and those simply riding the hype. The Russell 2000 is up 7.5% so far this year.

Despite the immediate tech headwinds, Niles remains constructive on the broader market for the first half of 2026, citing "easy money" drivers:

Q1 is benefiting from the tax advantages of Big, Beautiful Bill.

He also suspects a new Fed Chair will push for at least 100 bps in rate cuts.

He breaks down the earnings outlook for four of the Mag7 who are reporting this week.

Meta (META): While ad markets remain robust, the focus is on "Meta Compute"—a new initiative announced in mid-January 2026 aiming for tens of gigawatts of power capacity this decade. Niles fears this massive infrastructure pivot will spike 2026 capex and crush cash flow, drawing parallels to Oracle’s stock performance after its September 2025 results.

Microsoft (MSFT): Azure remains strong thanks to its 27% stake in OpenAI. OpenAI’s growth is staggering, exiting 2025 at a $20 billion revenue run-rate with projections for $44 billion in 2026. However, Niles flags risks to March quarter guidance due to rising memory prices hurting PC margins, and long-term competition from Google Gemini and Anthropic.

Tesla (TSLA): Demand concerns loom for 2026 following the expiration of the $7,500 EV tax credit on September 30, 2025. While Elon Musk’s future-looking narratives (Robo-taxis, FSD) often drive immediate post-earnings moves, Niles notes that valuation has mattered long-term: since 2021, TSLA is up only 10% compared to 47% for the S&P and Nasdaq.

Apple (AAPL): Expect a reset in March quarter EPS guidance due to memory costs. However, Niles remains bullish for the full year, viewing the upcoming foldable iPhone and AI-integrated Siri as a multi-year upgrade catalyst similar to the iPhone 6 cycle.

Beyond stock specific news, Niles is increasingly focused on credit as the "life blood of the economy." He is hedging with shorts against public and private credit providers, noting that the 2025 failures of First Brands (auto parts) and Tricolor (subprime auto) were just the beginning of a broader credit crunch.

Global macro risks are also surfacing in Japan. Following Prime Minister Sanae Takaichi's call for a snap election on February 8, 2026, Japanese 40-year yields surged 41 bps in two days. Niles warns that Takaichi’s "tax cut and spend" agenda could trigger a "Liz Truss-style" market reaction, making a Japan-focused hedge a key part of his current strategy.

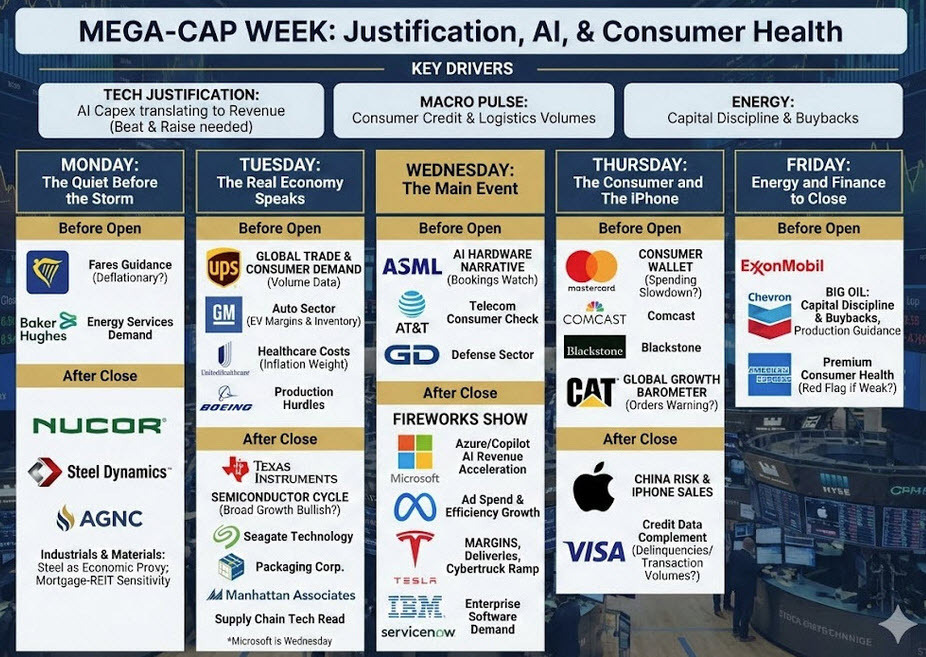

Here is more on the earnings schedule this week.