The Federal Reserve sets overnight borrowing rates, not long-term borrowing costs.

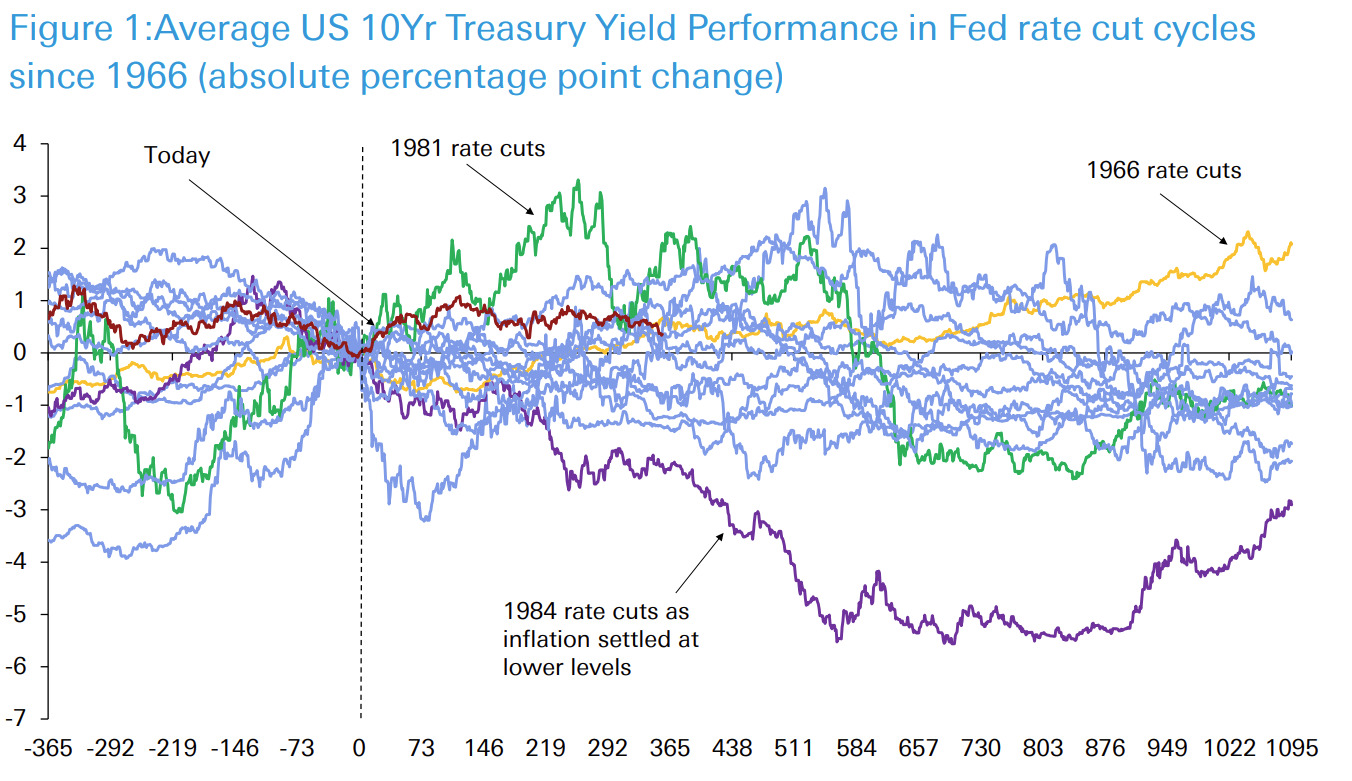

There isn't a great correlation between those two things either, as a chart from Deutche Bank today shows.

We are already one year into a Fed rate cutting cycle and yields are pretty much where they were beforehand. As DB highlights, at the one-year point, 10-year yields are about a coin flip on whether they're higher or lower than the start of the cutting cycle.

In the 13 distinct rate cutting cycles we have since 1966, the 10yr yield is lower in 6 of 13, and higher in the other 7. It’s higher today as well, so that would actually make 8/14 higher at this point. Interestingly the low point in 10yr UST yields since May 2023 was the day before this rate cutting cycle started a year ago.

My take from that is -- barring a crisis -- it's better to sell bonds at the start of a cutting cycle.

Ultimately, the circumstances around every cycle are different, from Covid to the Vietnam war. The 1966 outlier on this chart is one that got the attention of DB:

Interestingly, our current era has a lot of parallels with that policy error in the 1960s. That was also a period of low unemployment, yet governments were running larger budget deficits, and monetary policy was eased too.

DB rates strategists recently suggested selling 10-year notes.