The memes are sending a signal. And it turns out, it’s a massive fade.

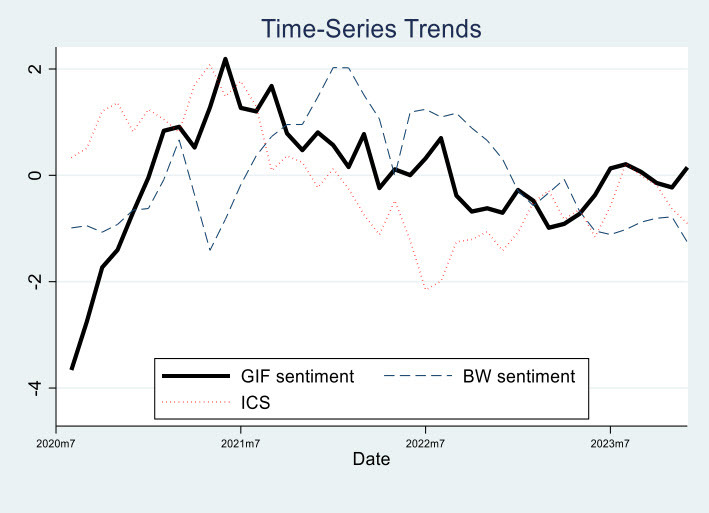

Just when you thought you’d seen every possible sentiment indicator—from the AAII survey (which I like) to counting the word "recession" in the WSJ—along comes a team of researchers from Hong Kong and USC with a metric that actually sounds like it belongs in the post-2020 trading era: GIFsentiment.

A new working paper titled "GIFfluence" digs into millions of posts on Stocktwits to see if those looping animations of rocket ships and crying bears actually predict price action.

The verdict? They do. But not in the way the posters intended.

The Gist: Visuals = Pure Emotion

The researchers argue that while text posts ("Buy $AAPL, earnings look good") often contain rational analysis, GIFs are pure "System 1" thinking—fast, emotional, and impulsive. They capture the raw mood of the retail crowd better than words ever could.

To build their index, they looked at millions of GIFs posted between 2020 and 2024. They calibrated the sentiment by checking which GIFs were most often paired with a user's "Bullish" or "Bearish" self-declaration button.

If users keep posting a specific GIF of Elon Musk smoking on a podcast while clicking "Bearish," the algorithm learns that GIF is a bearish signal.

The study found that when GIFsentiment spikes (meaning everyone is spamming bullish rocket GIFs):

Same Day: The S&P 500 tends to rise. The hype works in the immediate term.

Four weeks later: The market is lower.

The data shows that high GIF sentiment is a strong negative predictor of returns for the next four weeks. It’s essentially capturing peak exuberance.

The numbers are actually pretty startling:

A one-standard-deviation increase in GIF bullishness is associated with a 126.5 basis point drop in the S&P 500 over the following month

That annualizes to a roughly -16% drag.

The researchers say the correlation holds up after controlling for things like news and earnings but that sort of thing is very tough to do. They note that the signal is strongest in the highest-volatility stocks.

Why it works

The paper makes a compelling case that GIFs are a cleaner proxy for "investor mood" than text.

GIFsentiment correlates strongly with "bad mood" days—like days with heavy cloud cover or strict COVID lockdowns.

The argument is that when people are typing, they are reacting to news. When they are posting GIFs, they are reacting to vibes. And when the vibes get too hot, the market is vulnerable.

Unsurprisingly, this indicator screams loudest in the corners of the market where retail traders hang out. The predictive power is significantly stronger in small-cap stocks and high idiosyncratic volatility names.

If you see the small-cap boards lighting up with dancing bulls, be careful. This is something we've known for awhile but if you want to use this in your toolkit -- their GifIndex isn't published -- you should feel a bit of caution when you're seeing waves of bullish or bearish gifs.

The bottom line

We know retail sentiment is often a contrarian indicator, but this study puts some hard numbers on "meme euphoria."

The researchers conclude that visual sentiment is a proxy for misperceptions that get corrected within a month. So next time your feed is flooded with "to the moon" animations, remember: the data says the rocket is likely running out of fuel.

h/t @MKTWgoldstein