By Itai Levitan, Head of Strategy, investingLive.com

Michael Burry, the legendary investor known for “The Big Short,” has once again gone against the crowd. His latest target is Palantir Technologies (PLTR), one of the most talked-about and traded AI and data analytics stocks among retail investors.

According to the latest Q3 2025 13F filing, Burry’s fund, Scion Asset Management, disclosed put options representing about five million shares of Palantir. These filings give us a glimpse into his bearish stance, but not the exact timing or price levels of his trades. So, can we estimate where Burry might have entered, and whether his short position is currently profitable?

Let’s look at the charts and the clues.

Palantir’s price behavior during Burry’s Q3 short period

The yellow zone in the chart below represents Q3 2025, the period covered by the latest 13F. During that time, Palantir traded roughly between $129 and $190, with the midpoint around $156.

If we would look at one scenario (and not the most probable one, IMHO) that Burry built his short position gradually across that quarter, an average entry near of $156 would be the average entry price (again, I am not saying that this was the entry price, but looking at that one scenario). The stock just closed at almost $178, apx 14% higher than that theoratical entry price, so within that (less probable) scenario, Burry is quite deeply in the red.

However, sharp investors and traders like Burry would naturally have an earnings date in mind to consider as a key event, and there was one at the beginning of August. It is quite unlikely that an experienced trader would not want to gather more information from that earnings, and moreso, from the initial price reaction to the earnings. He may have intentionally dipped his feet in the water before that earnings release, but scaling up more seriously? Very likely that he would wait for more intel after Aug 04.

After the August 4 earnings, Palantir skyrocked over 18% within 6 trading days. Remember, all this is still within the yellow range and the quarter that we know, according to the 13F, when Michael took the short. When exactly and at what price? We do not know. But the midpoint of the green area, which is after that important earnings intel, has its midpoint at $164.15. This is the likely minimum price of the entry of that short.

Later came 27 Oct and the $190 high and key resistance that held for 76 days (53 trading days) was broken to the upside. Pressure for any short trader. On the next day it even faked as if is about to go down. $187-188 could be a reasonable price where even a pro like Burry would be scaling into that short, and happy to do so. But that was a bearish 'fakie' and in the next 4 days, Palantir rose over 9% to reach its All-time-high just before the next earnings announcement.

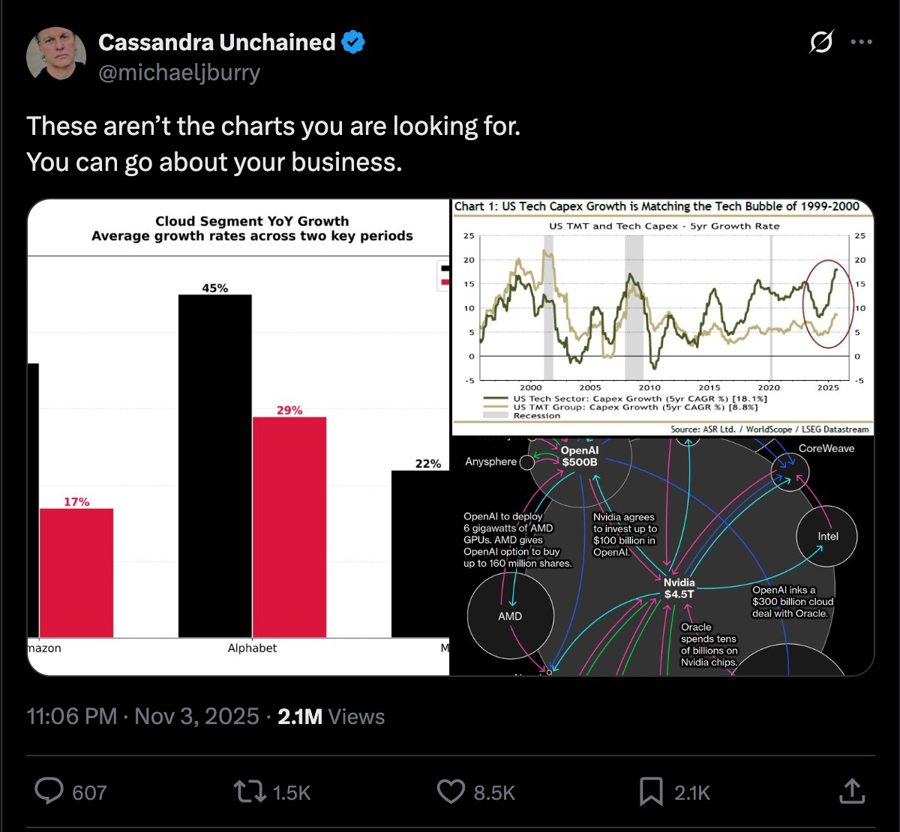

Michael seemd to have had enough of that crap. And he posted about it. Many of you have already seen that on X

Remeber, Burry was already short and price may have gone up even 15% against him at this stage. Minimum 9% against him, to give him a big discount. And before earnings, who knows what would happen next? Who would not feel the pressure?

Michael Burry’s tone and psychology on earnings day

On that November 3, the same day Palantir closed at its all-time high, Michael Burry posted on X:

“These aren’t the charts you are looking for. You can go about your business.”

The tone was calm but clearly sarcastic. It hinted that he viewed the ongoing rally as excessive, perhaps detached from fundamentals.

For any short trader sitting on a position while a stock continues to rise, that kind of post can be seen as a release of tension. Psychologically, it’s a way to reaffirm conviction without showing frustration. The timing of his post was striking, just hours before Palantir reported its earnings after the market closed. Whether intentional or not, it turned out to be a perfectly timed warning: after that tweet, PLTR dropped around 18.5 percent to the low of $168.91 by the end of last week.

So while the early part of his short may have been painful and too early, anyone who added or doubled down near that all-time high (which we have no idea if he did or not) could have turned a tough position into a profitable one within days.

Could Burry be profitable right now?

Let’s consider a few scenarios:

If Burry shorted in Q3 but after the important August earnings (midpoint near $164)

As of November 8, the stock closed at $177.93. That would still be quite negative for that short position.If his average entry price is around $180, just above the midpoint of period 3 in the above chart, which is a probable entry price considering he could have scaled in before the recent earnings (to average out a better entry price) then he may be even of just slightlly profitable. For now.

If he added or entered near the highs before earnings ($200–$207) and taken partial profit, or just re-raised big then

The post-earnings drop to $168–$170 would have delivered a clear short-term move of around 15%-18% (and a much bigger profit in % within the options play), on that last raise, and he's probably nicely profitable.

Given his tendency to hold puts for roughly 45 to 90 days, it is entirely possible that his current positions have time to play out. In options trading, time has value, and waiting is part of the cost structure.

If he initiated positions in mid-September, as the chart suggests could be reasonable for a late-Q3 entry, he would still be within his normal trade window. The stock’s quick reversal after the November 3 top would likely give him some relief, if not early profit.

If we consider only the 13F filling and the Q3 period short, without additional scaling into the short at higher prices, then Burry may still be down, even though PLTR declined over 18% since its ATH to last Friday's low. A reminder that entry prices matter. A lot. a good directional forecast, a great read, even a genuis read by a very experienced star, might, in some case, not be enough if your entry price is off. You were right about what is going to happen but not right about when it's gonna happen. And you paid dearly for the time that passed.

Of course, this is by no means the end of it. Even if the above is right (we do not know) then Burry probably has more time to win. He's actually pretty good at being too early and finding a way to still come out a winner. Even if in order to do that, he needs to pull out some additional moves to manage and optimize the position (For example, after Friday's close, I think we have at least a local dip, and the stock is going to have a leg up till $183 minimum, I would be considering some optimzation till then).

Estimated Durations of Michael Burry’s Put Positions

Based on public filings, we can only estimate the duration of Michael Burry’s put options, since SEC Form 13F doesn’t disclose strikes, expiration dates, or trade timing. By tracking when his positions appear and disappear across quarterly reports, most of his big short trades seem to fit short-to-medium maturities of about 30 to 90 days, with a common cluster around 45 to 75 days. Occasionally, positions lasting across two quarters suggest 3 to 6 month horizons or rolled contracts. These patterns indicate that Burry typically trades options designed for tactical moves over weeks or a few months, not long-term bets, though actual timing can vary depending on volatility, catalysts, or conviction.

Lessons for traders and investors

There are a few takeaways from this case that every trader and investor can learn from:

Patience and timing matter.

Even if you are right that something is over-priced, the market can stay exuberant longer than expected. Experienced traders know this. What they need to constantly work on is to synch this with their character. Some of us see things earlier than others but the market does not care about what we think. If you were right on the direct (up or down) but too early or too late, the market will punish you and your directional 'right'.Wait for exhaustion moves.

In speculative stocks like Palantir, extreme/exaggerated surges often mark the best entry points for shorts. This means that we need to wait till we see the first sign of "let's short" and hold ourselves hard. Then wait for the 2nd "now it must be a short" and hold ourselves harder. Finally wait for the 3rd and most ridiculous spot, on the verge of pissed-off feeling, perhaps even with a technical 'blow off top' or that yet another exaggerated move within 4 days, up 9% before the earnings, after being too frothy the previous two times we waited in suffering, and then finally pull the trigger, and with more ammunition this time.Shoot hard on the 3rd, wait out on the 1st and 2nd. Easier said than done but on retail darlings, that can work quite well if you can stomach that.

Partial profit-taking is a smart strategy.

Okay, PLTR crashed over 18% since its high. It does not mean that it won't retrace back up against you. Do you hang on now without doing anything? Or take partial profit, possibly re-entering at potential higher post-retracement prices? I guess that may be a matter of style and who am I to be suggesting to legendary Michael Burry what to consider. But even on other occasions, some of you traders that follow the tradeCompass methodology, or the trade ideas on our Telegram channel know that taking partial profit is a critical part of my philosophy.

I actually respect Burry even if Palantir may have printed a local bottom on Friday.

In my opinion, Michael Burry’s trade against Palantir shows both intellectual conviction and emotional resilience. Whether or not he is currently in profit, his ability to stay calm and contrarian during hype-driven markets is part of what sets him apart.

Personally, I have great respect for Burry’s originality and courage. I may not always agree with his timing, but I admire how he challenges consensus thinking.

If you’re reading this, Michael, I’d be honored if you shared your thoughts. This analysis is written with genuine respect and curiosity, not criticism.

Never underestimate Michael Burry. The game clock is still ticking. For the rest of us, Burry’s latest trade is a powerful reminder that markets often reward those who think differently, but especially those who can do that with the right timing and possibly stay agile to manage the trade as reality unfolds.

Now please make my day and comment. Thanks.