It's all looking fine and dandy with the TACO shells all over the floor. Trump walked back on his threats on Greenland as well as tariffs, allowing for the market mood to be lifted after the European close yesterday. Wall Street rebounded strongly and we're seeing major indices in Europe stick with that at the open today:

- Eurostoxx +1.2%

- Germany DAX +1.3%

- France CAC 40 +1.2%

- UK FTSE +0.7%

- Spain IBEX +1.0%

- Italy FTSE MIB +0.9%

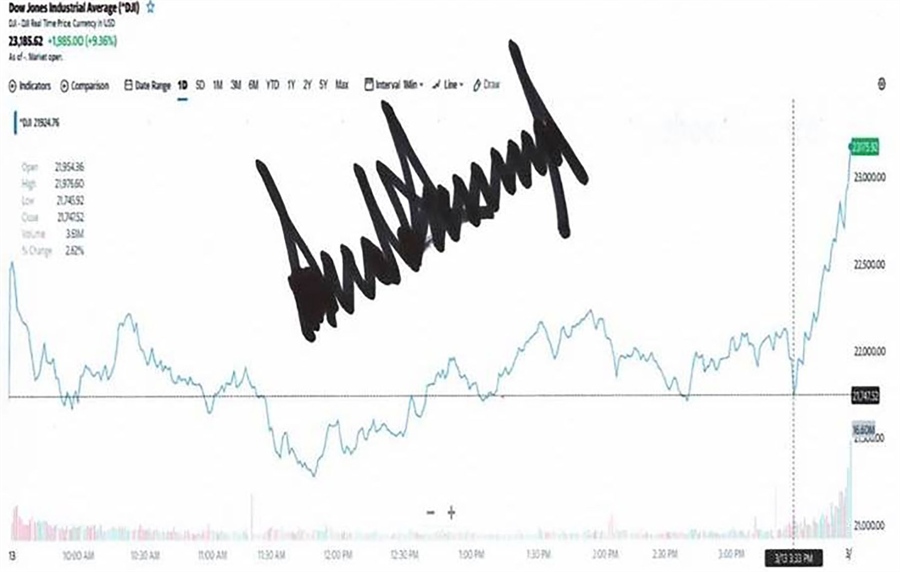

US futures are also posting modest gains in the early stages with S&P 500 futures up 0.4% and Nasdaq futures up 0.6% currently. Dow futures are also up 0.3% after posting over 1% gains yesterday, with Trump making sure that investors know that his number one priority and presidential benchmark performance is always the stock market. 📈

Remember this?

I want to say 'good times' but the Dow has more than doubled itself sine then. So, go figure.

Despite Trump lowering the temperature inside the room, the geopolitical landscape is still very much heated at the moment. Trump spoke to NATO secretary general Rutte in pushing for a "framework deal" yesterday.

But so far today, Denmark is making it clear that they weren't involved and there is nothing assuring about the conversation that was had. The Danish prime minister said that:

"NATO is fully aware of the Kingdom of Denmark's position. We can negotiate on everything political; security, investments, economy. But we cannot negotiate on our sovereignty. I have been informed that this has not been the case."

So, that will keep things interesting at least as geopolitical tensions will stay the course.

But as Trump rules out any meaningful escalation in terms of tariffs and forceful action over Greenland, markets can breathe a little easier and that is precisely what we're seeing in the immediate aftermath.

Whatever deal that will be constructed is a problem for another day.