I've been mulling the real US economy all day because with all the hoopla around gold, Trump and a war with Iran, the market is losing focus on the power of interest rates and the mountains of cash that Congress have shovelled towards the real economy.

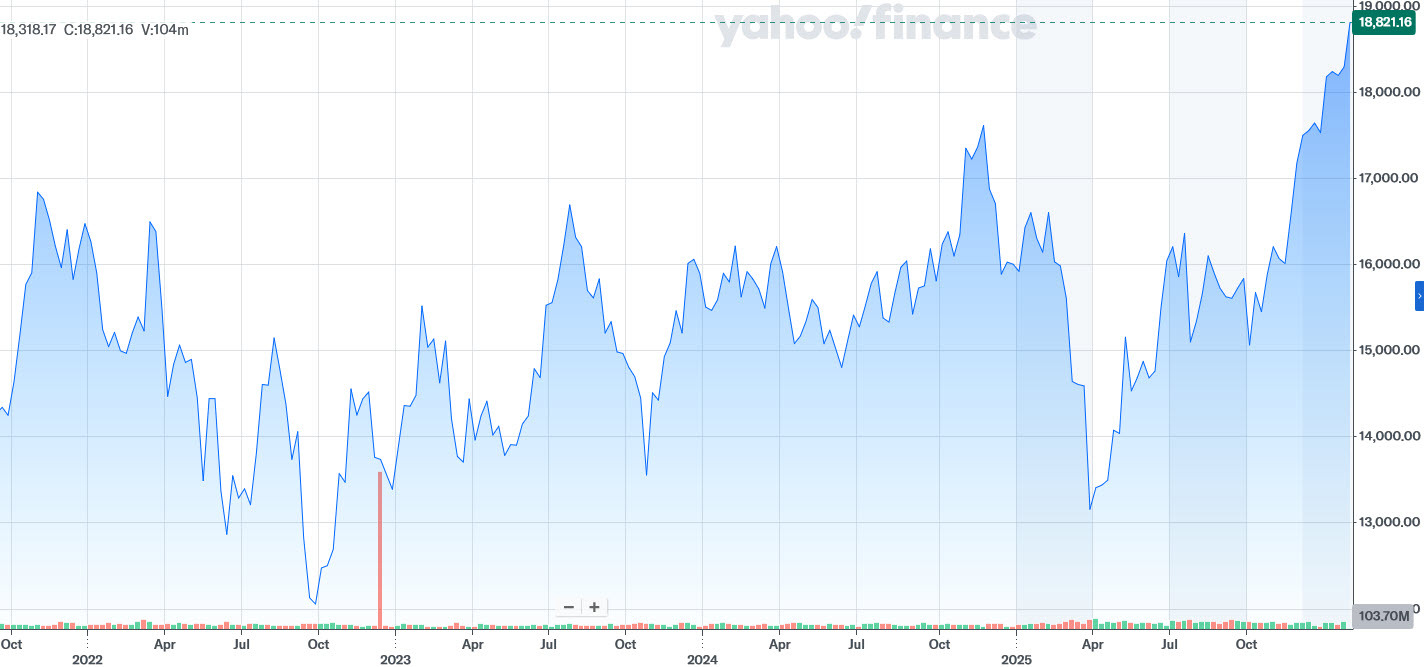

One notable barometer is the Dow Jones Transportation Average, which is trading at a record high.

It's up 2.75% today.

The best way to track it is the IYT ETF as it somewhat mimics it and is also flirting with a record high. The downfall of this ETF is that it has a heavy weighting (19%) towards UBER, which is definitely a transportation company but trades more like a tech company.

The positives in the index (and ETF) are the real-economy barometers that are on nice runs. Fedex is up 50% since September and 3.7% today. Airlines have posted large gains recently and railways are now coming to life. CSX today hit the best levels since Feb 2024.

Even the battered trucking and freight industry is coming to life.

Here are the Dow Transports 20 components and today's market moves:

Airlines

Alaska Air Group (ALK): +2.85%

American Airlines Group (AAL): +2.29%

Delta Air Lines (DAL): +4.04%

Southwest Airlines (LUV): +3.98%

United Airlines Holdings (UAL): +4.43%

Railroads

CSX Corporation (CSX): +1.71%

Norfolk Southern Corporation (NSC): −0.23%

Union Pacific Corporation (UNP): −0.16%

Delivery & Logistics

United Parcel Service (UPS): +4.05%

FedEx Corporation (FDX): +3.81%

Expeditors International (EXPD): +1.98%

Trucking & Freight

C.H. Robinson Worldwide (CHRW): +1.83%

J.B. Hunt Transport Services (JBHT): +4.06%

Old Dominion Freight Line (ODFL): +6.64%

Ryder System (R): +5.91%

Landstar System (LSTR): +6.13%

Other Transport Services

Avis Budget Group (CAR): −0.17%

Kirby Corporation (KEX): +1.00%

Uber Technologies (UBER): +1.15%

It's safe to say that the market is taking notice of today's strong ISM manufacturing survey.