The huge moves today in Meta (+10.3%) and Microsoft (-11.9%) highlight the stakes in earnings season.

The calendar hardly slows down today with some other major companies and high flyers reporting.

The big one is Apple, which is off to a tough start this year after climbing nicely in the second half of 2025 as it avoided the generative AI spending race.

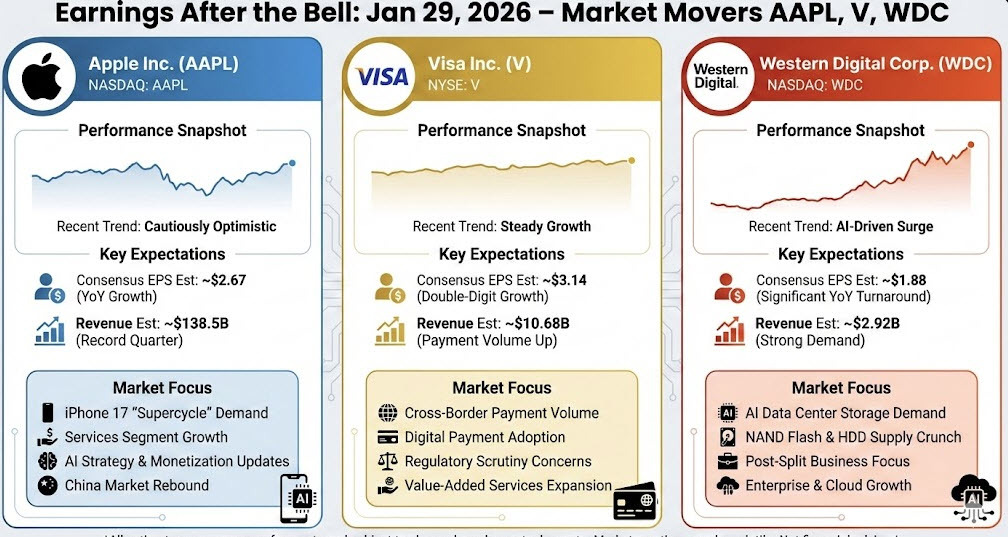

Expectations: Analysts expect a strong quarter with consensus EPS estimates around $2.67 and revenue projected to reach approximately $138.44 billion.

What to Watch: Key areas of focus include demand for the iPhone 17 "supercycle," growth in the high-margin Services segment, performance in the critical China market, and updates on the company's artificial intelligence technology.

Visa Inc. (V)

Expectations: The consensus EPS estimate is currently $3.14 on revenues of $10.68 billion, representing double-digit year-over-year growth for both metrics.

What to Watch: Investors will be looking at growth in total payments volume and processed transactions, weighing them against the impact of higher operating expenses and client incentives.

Western Digital Corp. (WDC)

Expectations: Consensus estimates place EPS at $1.88 (some as high as $1.99), with revenues expected to be around $2.92-$2.95 billion.

What to Watch: The primary catalyst is the AI-driven surge in demand for high-capacity data center storage. Analysts are also focused on the company's progress with new technologies like HAMR.

SAP SE (SAP)

Expectations: While recent reports indicate a beat on EPS estimates, the company's 2025 cloud revenue forecast has disappointed the market.

What to Watch: The key focus is on cloud backlog and revenue growth trajectory, particularly in light of concerns about the disruptive effects of AI on the sector.

Dolby Laboratories, Inc. (DLB)

Expectations: Analysts forecast EPS at either $0.84-$0.90, with revenue expected around $341.26 million.

What to Watch: The market will be looking for an earnings beat and upbeat forward guidance, which could lead to a post-earnings rally.

Beazer Homes USA, Inc. (BZH)

Expectations: Analysts expect a swing to a loss, forecasting an EPS of -$0.49 and revenue of $423.23 million, a significant year-over-year decline.

What to Watch: The focus will be on the company's performance amid a challenging backdrop that is expected to result in a quarterly loss.