Major US stock indices are opening lower despite better earnings to kickstart the earnings calendar. Worries about US/China relations, and the US government shutdown leading to slower growth is hurting equities. Technically, the NASDAQ index and S&P indices are back below the 200 hour moving averages.

The NASDAQ index is down -410 points or -1.82%. The S&P index is down -1.25% and the Dow industrial average is down -1.02%

For the NASDAQ index, the price gapped higher yesterday and closed just under the 100 hour moving average (blue line on the chart below at 22692). Today was going to be a key barometer for both buyers and sellers with a move higher tilting the bias to the upside, and a move lower tilting the bias lower.

The gap to the downside has now taken the price back below its 200-hour moving average at 22418, putting the sellers in control as long as that MA now holds resistance. That moving average will be a barometer for buyers and sellers now. Staying below is more bearish. On the downside, the 38.2% retracement of the move up from the early August low comes in at 22143.26. That is the next major target on the downside.

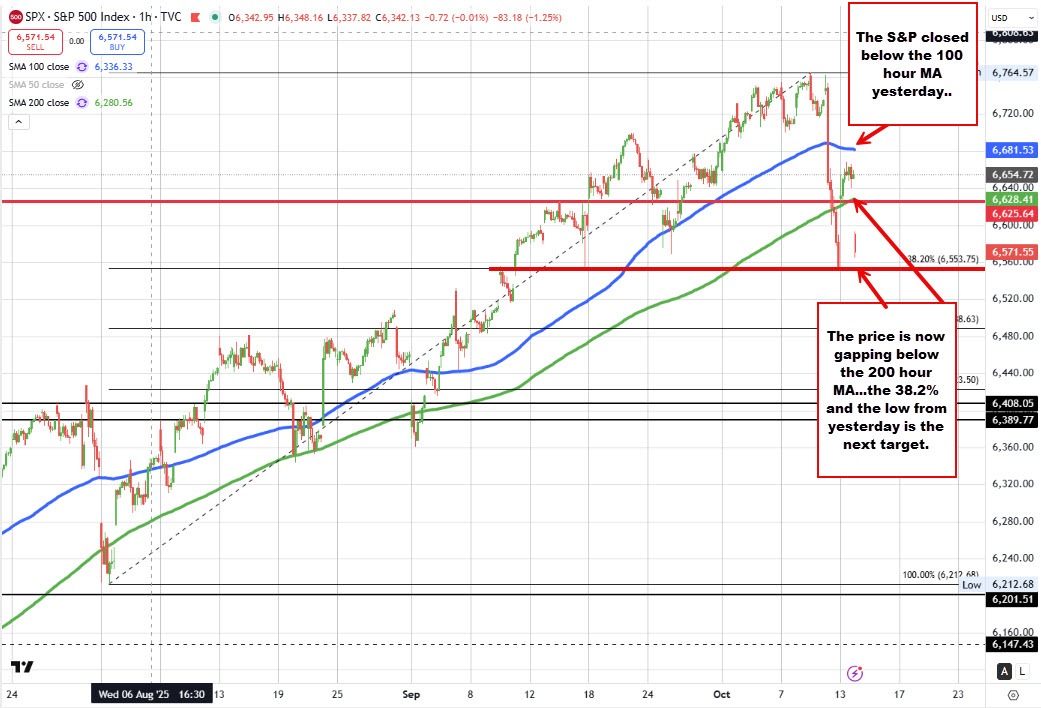

The S&P index is also below the 200 hour MA and is now approaching the 38.2% retracement and low from yesterday. It is targeting the 38 2% retracement at 6553.75. There was also near the low from yesterday , and the low price going back to September 17 (see chart below).

Looking at some of the companies that issued earnings this morning (and beat on the top and bottom line):

- J&J is up around 1%

- Wells Fargo is up 4%

- JPMorgan -2.9%

- Goldman Sachs -3.85%

- Citigroup +0.15%

- BlackRock +2.24%