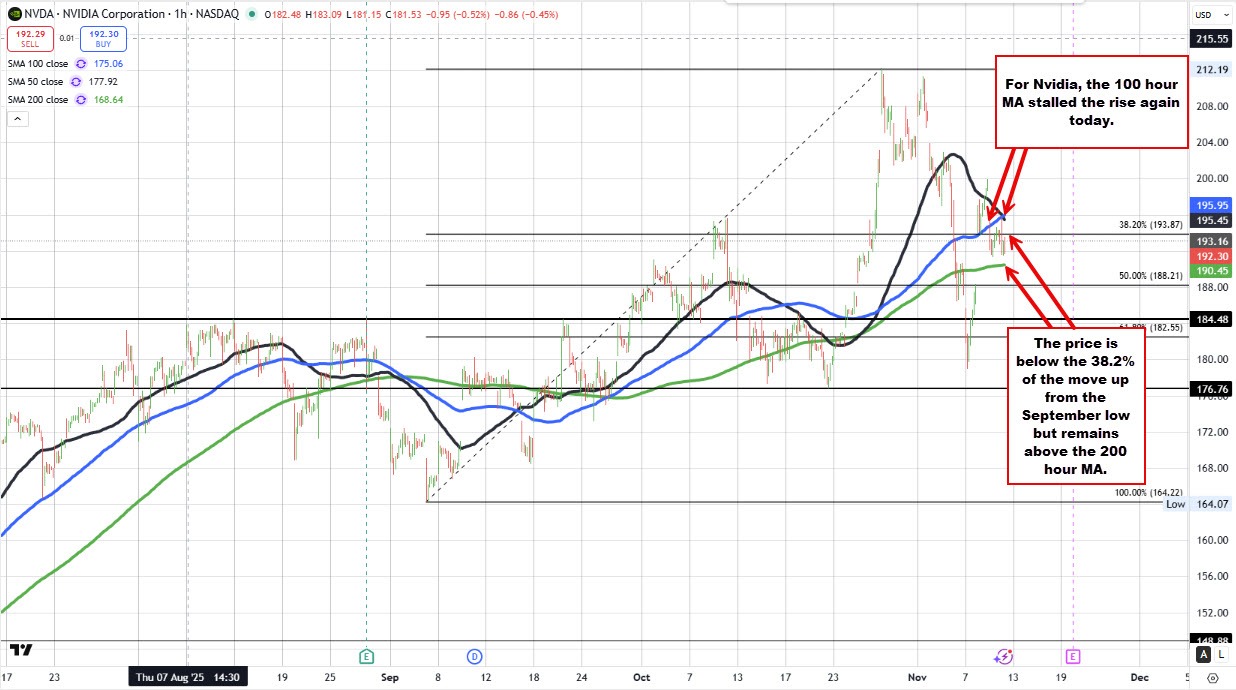

In the post and video from yesterday (see: Nvidia Technicals: Nvidia is down sharply. What has done to the technicals?"), I pointed out that the price of Nvidia moved below the 50 and 100 hour MA, tilting the bias to the downside today, the price opened higher.

At the open today, the price of Nvidia moved higher but quickly met resistance from sellers near the converged 50- and 100-hour moving averages, both around $195.60. Sellers leaned against that zone and successfully pushed the price back lower. The decline also took the stock back below the 38.2% retracement of the rally from the September low to the October all-time high, which sits at $193.87.

To rebuild a bullish bias, the price would need to break back above both the 38.2% retracement and the 50/100-hour MAs. Absent that, the focus turns to the downside, where the 200-hour moving average at $190.45 is the next target, followed by the 50% retracement of the same move at $188.21. A sustained break below both of those levels would deepen the bearish tone and open the door for further selling pressure as the technical picture deteriorates.