Morgan Stanley is sticking with its bullish stance on Tesla, reiterating an Overweight rating and $410 price target even as the stock comes under pressure following CEO Elon Musk’s public spat with former President Donald Trump.

In a note to clients, the bank acknowledged the recent volatility but downplayed long-term risks, including concerns around EV tax credit cuts. Analysts said these are not a major long-term concern and reiterated that Tesla’s value proposition extends well beyond electric vehicles.

The stock’s recent rally, Morgan Stanley noted, had been fuelled by investor optimism that Musk would re-centre his attention on Tesla’s core business. The Trump clash, however, could dent consumer sentiment across the political spectrum in the short term.

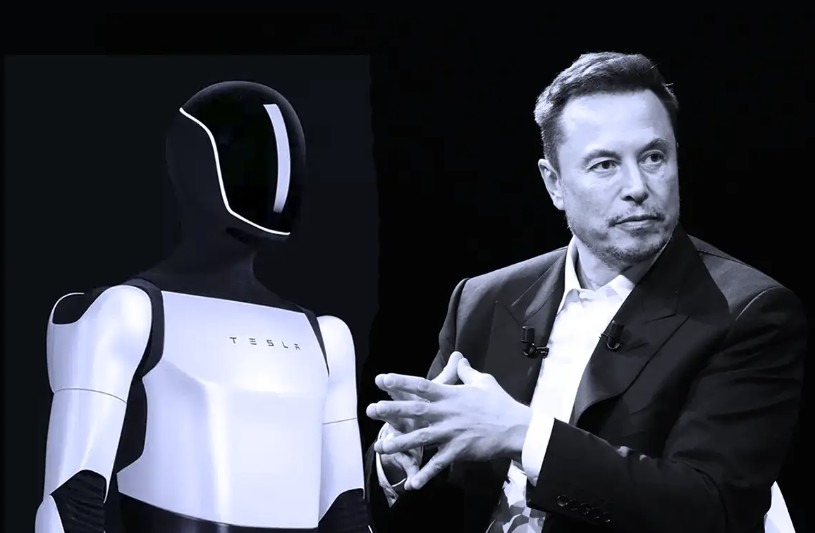

Still, the firm sees Tesla’s strength in areas like AI, robotics, energy solutions, and infrastructure as both durable and largely insulated from political turbulence. The company’s AI and tech assets remain underappreciated the analysts wrote, urging investors to look past near-term noise to focus on Tesla’s longer-term growth trajectory.

Morag Stanely note from late last week ICYMI.