The major US indices are trading mixed with the Dow industrial average higher by about 0.62%. The S&P near unchanged at 0.08%, and the NASDAQ index down -0.40%.

Shares of Nvidia are lower by about -5.39% after overnight news that Google and Meta are in talks that could shift major AI workloads away from Nvidia and AMD toward Google’s custom Tensor Processing Units (TPUs).

Nvidia shares moved to a low of $169.55 in the 1st hour of trading. That was the lowest level going back to September 17. Technically, the next key target comes near the 38.2% retracement of the move up from the April low. That level comes in at $164.22. However, there has been a rebound and the current price trades down $9.66 or -5.3% at $172.90. There is a topside resistance near swing level lows from October near $176.76 up to $177.25.

The price highs from yesterday and Friday extended below its 50 hour moving average at $182.55 currently (black moving average line on the chart below).

Meanwhile, Alphabet continued its rise reaching a all-time high of $328.83. The price has come off its high and trade only up $3.50 or 1.09% at $322. Looking at the hourly chart, there is a gap between $306.42 and $309.60. Traders will be watching that area for support on any dip.

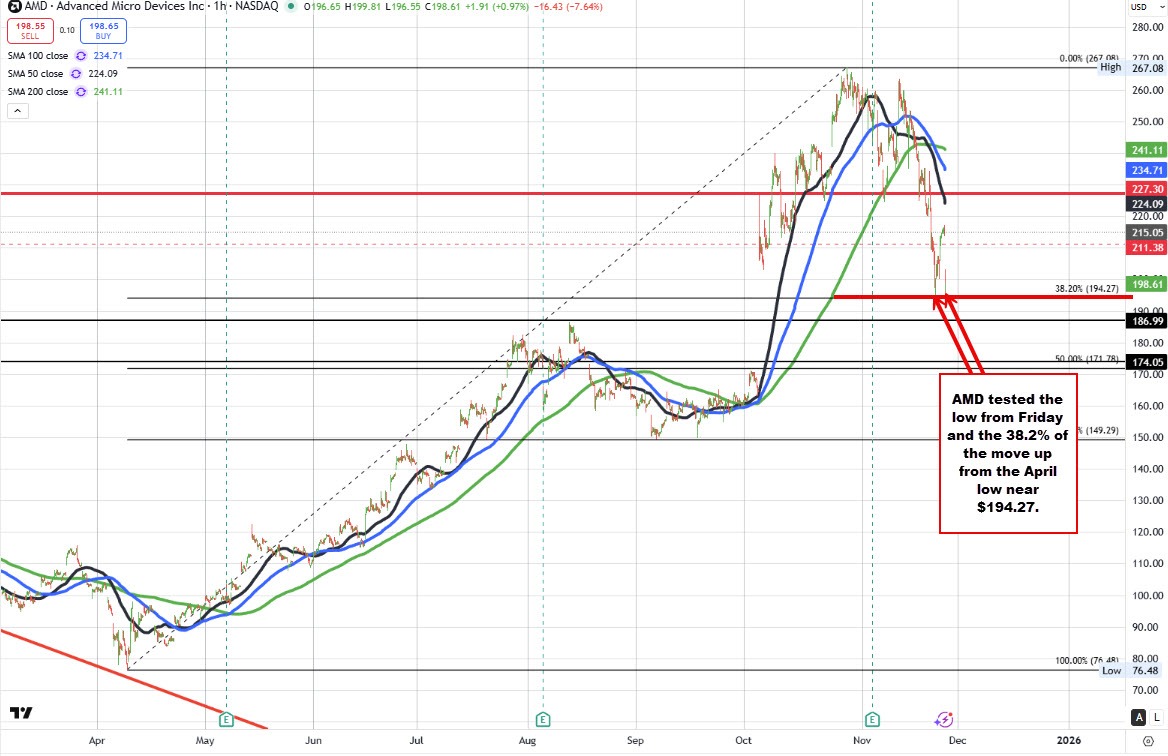

AMD shares are down sharply by -7.51% at $198.90. Its low price today extended to $194.28. At session lows it tested the 38.2% of the move up from the April low at $194.27. That was also near the low from last Friday.

Meta shares are up 2.5% to $628.48. The shares have moved back above its 100 hour moving average at $610.54. If there is competition to Nvidia's chips, that the lower the capital costs for companies like Meta. Bad news for Nvidia's dominance is good news for Meta and other chip buyers. The 50% midpoint of the move up from the April low in Meta comes in at $637.67. The 200 hour moving average is at $660.58. Both of those levels would need to be broken to increase the bullish bias technically. The 100 hour moving averages now close risk at $610.53.