Beijing deploys state-linked investors to moderate AI-driven stock speculation.

ps. Chinese markets are closed this week:

Summary:

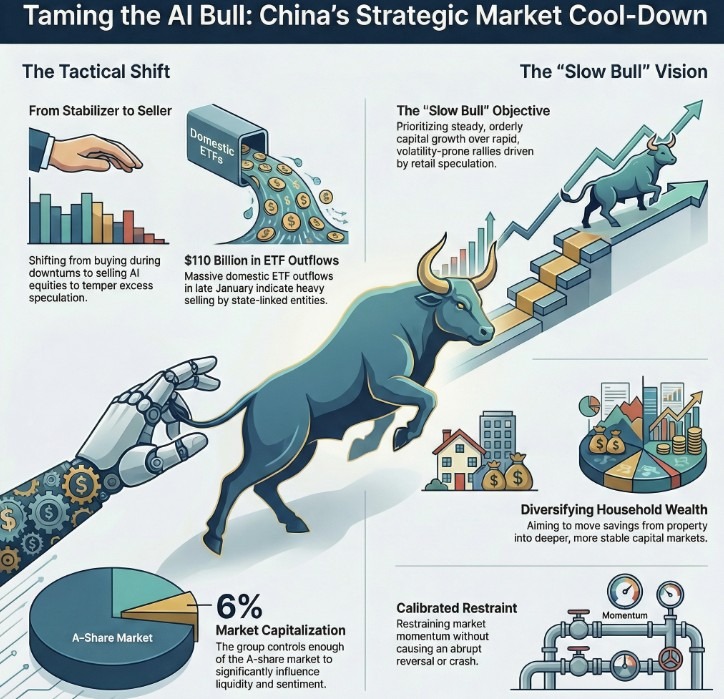

China’s “national team” selling equities, aiming to cool AI-driven speculation.

Shift from traditional buyer role, previously used to stabilise markets during downturns.

~US$110bn ETF outflows cited, consistent with state-linked selling activity.

Group controls significant market exposure, estimated at around 6% of A-share capitalisation.

Policy goal: foster stable, long-term equity culture while avoiding bubbles.

China’s state-linked “national team” of investors has shifted into selling mode as authorities seek to temper excess speculation in artificial intelligence-linked stocks, according to reporting by the Wall Street Journal.

The group, widely understood by market participants to comprise state-backed funds and financial institutions, typically functions as a stabilisation force during market stress. It has historically stepped in as a buyer of exchange-traded funds and index products during periods of sharp volatility, including the 2015 market rout and more recent tariff-driven turbulence.

However, officials appear increasingly concerned about overheating conditions in parts of the equity market. Recent strong gains in AI-related shares and record trading volumes have prompted policymakers to prioritise orderly, long-term capital formation over speculative surges. Regulatory officials have emphasised the need to prevent sharp market swings and encourage rational investment behaviour.

Data cited by Goldman Sachs indicate nearly US$110 billion in outflows from China-focused domestic ETFs in the latter half of January, suggesting significant selling pressure consistent with national team activity. Analysts describe the approach as calibrated — restraining momentum without abruptly reversing it.

The national team is believed to include entities linked to China’s sovereign wealth apparatus, margin financing vehicles and state-backed asset managers. Estimates suggest the group holds exposure equivalent to roughly 6% of China’s A-share market capitalisation, underscoring its capacity to influence liquidity and sentiment.

Beijing’s objective appears twofold: nurture a sustainable equity culture while preventing destabilising bubbles. Household financial assets remain heavily concentrated in property, and authorities want deeper capital markets to diversify savings channels and support corporate funding.

At the same time, policymakers are wary of retail-driven speculation, given that individual investors account for a majority of daily trading activity. The intervention signals a preference for what some analysts describe as a “slow bull” environment — one marked by steady gains rather than rapid, volatility-prone rallies.