We had a good run in the S&P 500 as the market continued to rally on de-escalation expectations. There's an old adage saying that "bull markets climb a wall of worry" and that's exactly what happened in the last weeks.

We went pretty quickly from strong pessimism to optimism and the positioning got a bit overstretched. Today, we have the FOMC policy decision and a pushback against the dovish market pricing could trigger some short-term weakness in the stock market.

The optimism for trade deals though will likely trump the negative reaction and keep the uptrend intact. The only thing I can see changing the trend at the moment is a disappointing first trade deal as the market would revise its expectations on the more negative side.

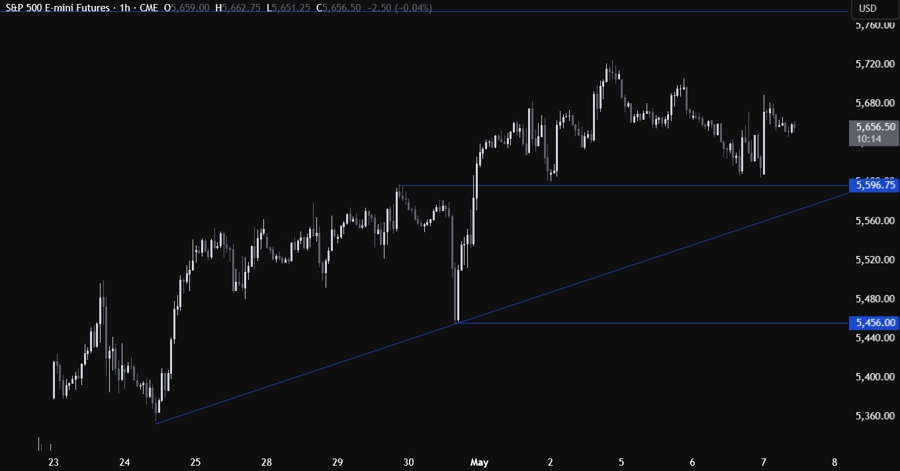

On the 1 hour chart, we can see that we have a nice support zone around the 5,590 level where we can also find the trendline for confluence. That's where we can expect the dip-buyers to step in with a defined risk below the trendline to position for a rally into new highs. The sellers, on the other hand, will want to see the price breaking lower to extend the pullback into the 5,456 level next.