The US dollar is stronger across the board after US GDP in Q1 grew just 1.1% compared to 2.0% expected.

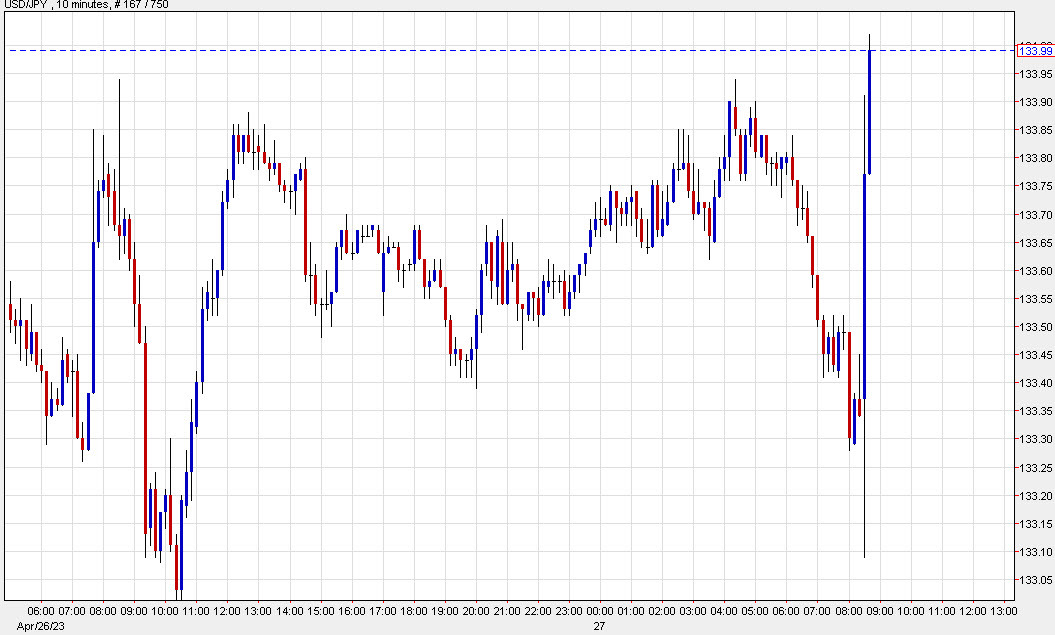

USD/JPY is up about 60 pips and the strength in the dollar is broad based.

US Treasury yields are also higher after the print, with 2-year notes up 10.1 bps to 4.02%.

Not surprisingly, it's all about the details of the report. A big one is that inflation measures in the report ran high in a sign that the Fed will need to keep rates higher for longer.

Equally important was the composition of the report as it showed strong underlying demand. Consumer spending rose 3.7% including at 16.9% increase in spending on durables. Some of that isn't sustainable but there certainly hasn't been a crack in the consumer and that fits in with what credit card companies said this week after earnings.

Finally, the headline GDP number was dragged down by a change in inventories. Had they stayed flat, GDP would have been 2.26 percentage points higher, or roughly 3.36%. Much of that was priced in but it still underscores that this economy is running hotter than it looks.