The FOMC rate decision and Chair Powell’s press conference will be the main focus next week. Alongside the Fed, three other central banks will also announce policy decisions: the Bank of Canada is expected to cut rates by 25 bps, while the Bank of England and the Bank of Japan are likely to hold steady. Markets will be watching closely for signals on the future policy path from all four. Below is a summary of the key central bank decisions and major economic releases on the calendar.

Monday

China activity data: Retail sales (3.8% estimate), industrial production (5.7% estimate), and fixed asset investment for August – closely watched for signs of property sector weakness and overall growth momentum.

Tuesday

UK jobs report: Unemployment expected steady at 4.7%; wage growth remains a focus. Claimant count 20.3 K versus -6.2 K last month

German ZEW survey: Outlook on economic sentiment in Germany. Estimate 26.4 versus 34.7 last month

Canadian CPI: Headline inflation expected to ease further, shaping BoC expectations.

US retail sales: Expected +0.1% m/m versus 0.3% last month, with autos weaker but core spending resilient.

Wednesday

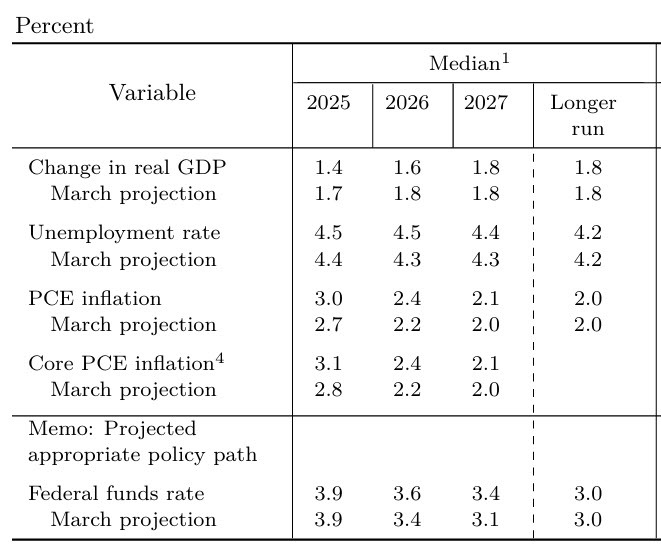

Fed (FOMC) meeting: Expected 25bp rate cut to 4.00–4.25%; Fed will also publish updated economic projections. Focus will be on what expectations are going forward. In June, the FOMC saw rates moving to 3.9% at the end of 2025 and 3.6% by the end of 2026. Focus will be on the comments from Fed chair Powell with any clues on what might be the neutral rate.

Bank of Canada meeting: Market expects a 25bp cut to 2.5% from 2.75%; labor market and tariffs in focus.

New Zealand GDP (Q2): Weak momentum expected. Estimate -0.3% versus +0.8% in the 1st quarter

Thursday

Bank of England meeting: The BoE is expected to hold Bank Rate at 4.0%, with markets assigning a near-99% chance of no change. While inflation has eased, it remains above target, and the labor market is still tight, prompting the Bank to stress that policy must stay “restrictive.” Attention will be on whether the BoE hints at larger cuts later this year or signals a slower pace of QT as growth momentum cools.

Friday

Bank of Japan meeting: Expected to keep rates at 0.5%, though political shifts raise uncertainty around timing of normalization. Focus will be on any sort of indications of a hike and when..

UK retail sales (Aug): Expected +0.3% m/m, with core steady at 0.5%.

Quad witching: Options/futures expiry may boost market volatility.