The main focus will be on the key central bank policy decisions that is to come. However, essentially we are following a sort of standard template when it comes to understanding what markets are focusing on in the past few months. And March will be no different.

As the tightening cycle looks to come to an end and markets are busy focusing on inflation and policy pivots, it's all about central bank expectations and pricing at the moment.

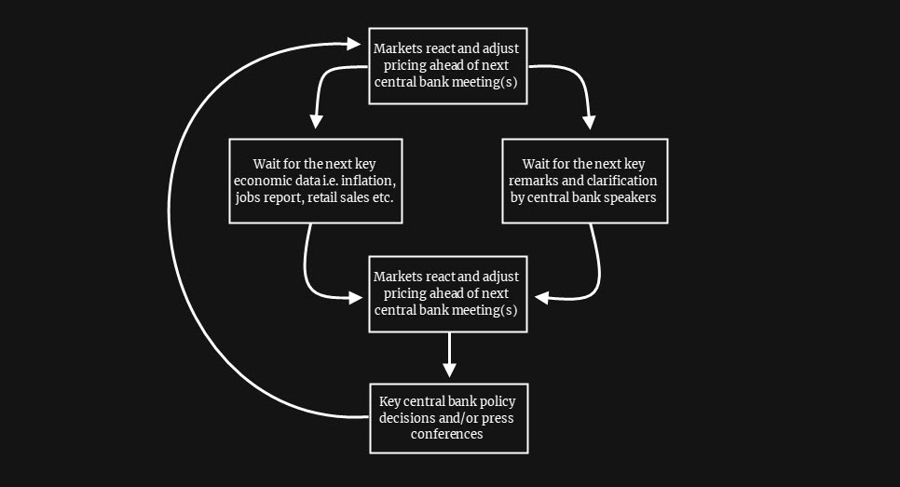

The flow chart above pretty much sums up how markets are looking at things currently. Sure, there might be the odd data and central bank policy meeting jumbled up at the same time but the only difference is that it might make it trickier for markets to try and anticipate and/or gauge what central bankers may communicate at that point in time.

This month will be one of those months.

Let's first take a look at the dates for the major central bank policy decisions in March.

- RBA (7/3)

- BOJ (8/3)

- BOC (8/3)

- ECB (16/3)

- Fed (22/3)

- SNB (23/3)

- BOE (23/3)

And now on to the more relevant data ahead of those central bank meetings (bolding what is the more important ones), with the focus being on the Fed of course considering that broader markets are more dialed in and are more sensitive to US data mostly at the moment.

- Australia January CPI, Q4 GDP (1/3)

- US February ISM manufacturing PMI (1/3)

- US February ISM services PMI (3/3)

- Switzerland February CPI (6/3)

- US February ADP employment data (8/3)

- US February non-farm payrolls (10/3)

- Canada February jobs report (10/3)

- UK February jobs report (14/3)

- US February CPI data (14/3)

- US February PPI data (15/3)

- US February retail sales (15/3)

- New Zealand Q4 GDP (16/3)

- US March U.Michigan consumer sentiment (17/3)

- Canada February CPI data (21/3)

- UK February CPI data (22/3)

As you can see, there is going to be plenty of key economic data releases scrunched in together with the major central bank policy decisions outlined above. What makes it worse is that markets might be left guessing and speculating for about a week or two, especially ahead of the Fed, since the US non-farm payrolls falls on 10/3 and the FOMC blackout period begins the day after.

That means we won't be hearing any Fedspeak whatsoever in between that and the Fed policy meeting decision on 22/3, while having to wrestle through inflation and consumption data.

In any case, we'll cross that bridge when we get there. But essentially, March will be another month where central bank policy decisions and market pricing for the next ones will dominate trading sentiment once again.