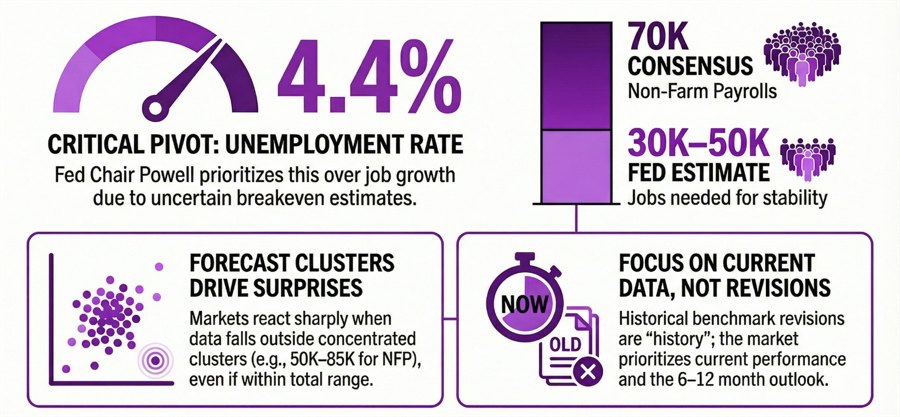

The ranges of estimates are important in terms of market reaction because when the actual data deviates from the expectations, it creates a surprise effect. Another important input in market's reaction is the distribution of forecasts.

In fact, although we can have a range of estimates, most forecasts might be clustered on the upper bound of the range, so even if the data comes out inside the range of estimates but on the lower bound of the range, it can still create a surprise effect.

Non-Farm Payrolls

- -10K to 135K range of estimates

- 50K-85K range most clustered

- 70K consensus

Unemployment Rate

- 4.5% (12%)

- 4.4% (77%) - consensus

- 4.3% (11%)

Average Hourly Earnings Y/Y

- 3.8% (6%)

- 3.7% (32%)

- 3.6% (55%) - consensus

- 3.5% (6%)

Average Hourly Earnings M/M

- 0.5% (2%)

- 0.4% (7%)

- 0.3% (80%) - consensus

- 0.2% (11%)

Average Weekly Hours

- 34.3 (21%)

- 34.2 (76%) - consensus

- 34.0 (3%)

We can see that the range of estimates for the headline NFP number is very wide. The consensus might feel like too high, but even a miss wouldn't be that bad. In fact, given the lower labour supply, the Fed estimates that the US needs to create between 30K and 50K jobs per month to keep the unemployment rate stable.

With this report we will also get the benchmark revisions to establishment survey payrolls for the period through April 2025. The final revision is expected to be smaller than the preliminary 911K decline, but overall revisions may show 2025 payroll growth averaging closer to 20K–30K rather than the currently reported 49K. There's been too much focus on this revision and my personal view is that nobody should care about it. That's history. What matters is how the labour market is doing now and how it performs in the next 6-12 months.

The household survey data, including the unemployment rate, will not be revised. Moreover, Powell mentioned that they are more focused on the unemployment rate given that the breakeven job growth estimate might be wrong. Therefore, the unemployment rate should be the most important number. Given the strong consensus for a 4.4% rate, a miss or a beat would be a surprise.