It’s finally the US CPI Day. Markets have been waiting eagerly for this moment and it will likely lead to a more sustained trend. We will also get the US Retail Sales figures released at the same time but it’s fair to say that barring huge surprises, they won’t matter that much.

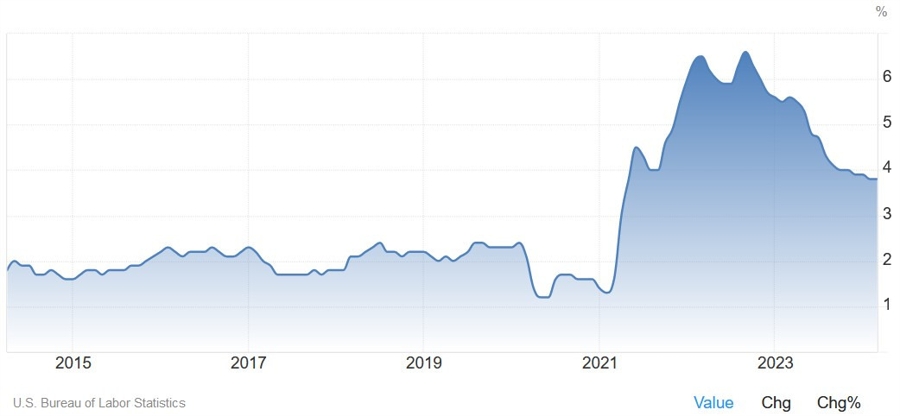

US CPI 12:30 GMT (08:30 ET)

The US CPI Y/Y is expected at 3.4% vs. 3.5% prior, while the M/M measure is seen at 0.4% vs. 0.4% prior. The Core CPI Y/Y is expected at 3.6% vs. 3.8% prior, while the M/M reading is seen at 0.3% vs. 0.4% prior.

Given the market’s pricing and general fear of persistently high inflation, a downside surprise will likely trigger a much bigger reaction than an upside surprise. Fed Chair Powell pushed back against rate hikes expectations at the last FOMC Press Conference as he stated that they would need “persuasive” evidence that their policy isn’t restrictive enough. He repeated basically the same message yesterday at an event at the foreign bankers association.

So, if inflation remains high but doesn’t re-accelerate notably, they will just keep rates higher for longer. The market expects almost two rate cuts (45 bps) by the end of the year which can easily go back to one or even zero in case we get another hot inflation report. A soft report might add one extra cut to the pricing but not much more as the Fed will want to cut rates at a meeting containing the SEP (barring a quick deterioration in the labour market), which falls in September at the earliest.

Looking at the big picture, I’d say the bigger risk is inflation getting stuck above the Fed’s target rather than a second wave. Such a scenario though could change long term expectations if inflation remains high for too long. At that point, a second wave would be likely.

Right now though, we are not seeing that. Yes, some measures of inflation expectations ticked higher recently, but they are mostly rangebound. Leading indicators show that the labour market is easing, and wage growth is slowly returning to pre-pandemic levels.

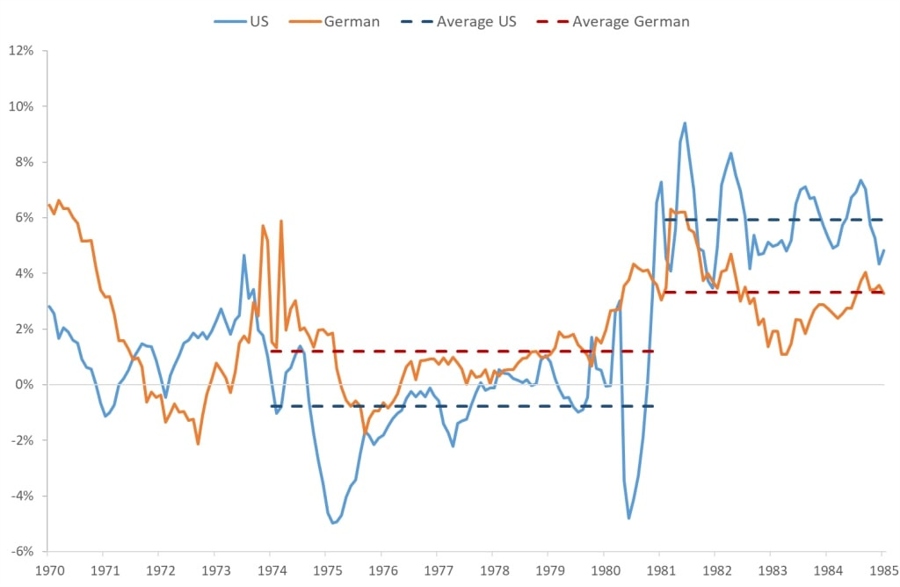

The Fed is looking at the yield curve and real rates and sees the policy setting restrictive, which is technically correct. Some say that it looks like the 70s but back then real rates were negative, and we hadn’t the 2% target that anchored expectations.

In the chart above, we can see a simple example with US vs. German real rates in the 70s. US had negative real rates for most part of the 70s while the Germans had positive real rates. The inflation rate in Germany averaged around 4.8% with lower volatility while in the US it was almost double with higher volatility.

Everyone knows that the Fed made a mistake with the December 2023 pivot as that unleashed the “animal spirits” in the markets, but the Fed re-pivoted in March 2024 favouring a higher for longer stance until they gain enough confidence that inflation is returning to target.

I’d say the trade was in Q1 2024 when we repriced the seven rate cuts. Now, we are in kind of a limbo where we are seeing growth with disinflation decelerating or even stopping. This kind of environment should favour stocks over bonds and generally be positive for risk sentiment until something breaks.

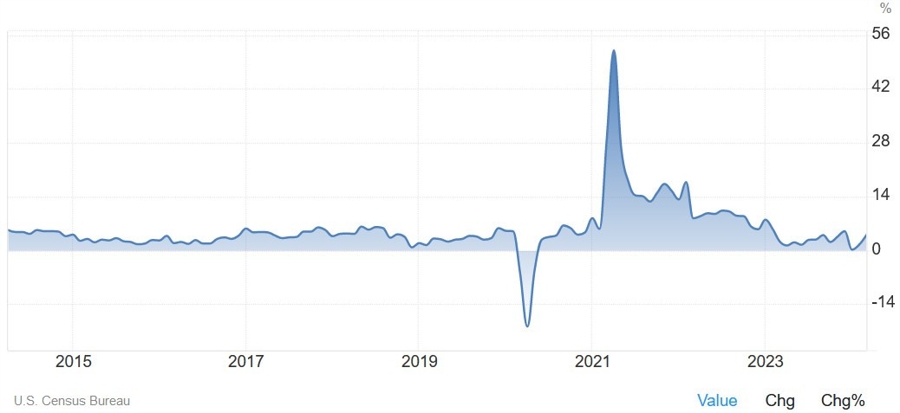

US RETAIL SALES 12:30 GMT (08:30 ET)

The US Retail Sales M/M is expected at 0.4% vs. 0.7% prior, while the ex-Autos M/M figure is seen at 0.2% vs. 1.1% prior. We got some soft consumer sentiment reports recently which might filter through lower consumer spending. The retail sales data is notoriously volatile and given that it will be released at the same time of the CPI report, the market will likely ignore the release barring huge surprises.