EUROPEAN SESSION

In the European session, we don't have much on the agenda other than a few low tier releases that won't change anything for the market or the central banks. Expect to hear a lot of ECB speakers throughout the session as it's usually the case after an ECB policy meeting. They are unlikely to say anything new though.

AMERICAN SESSION

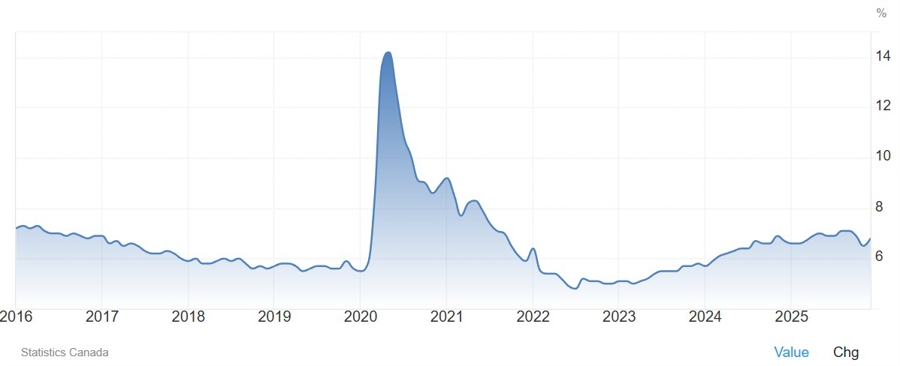

In the American session, the highlights include the Canadian jobs report and the US University of Michigan Consumer Sentiment survey. The Canadian labour market report is expected to show 5K jobs added in January vs 8.2K in December, and the Unemployment Rate to remain unchanged at 6.8%.

The Bank of Canada switched to a hard neutral stance at the last policy meeting as it changed the guidance from "Governing Council sees the current policy rate at about the right level" to "Governing Council judges the current policy rate remains appropriate". Governor Macklem mentioned that they don't expect the unemployment rate to rise further, so unless we get some big surprises, the data is unlikely to change much for the current market pricing which sees just 3 bps of tightening by year-end.

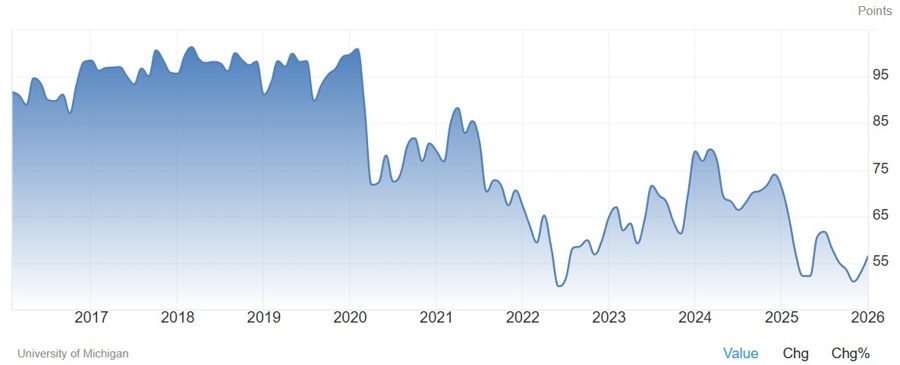

The University of Michigan Consumer Sentiment is expected at 55.0 vs 56.4 prior. After slipping towards record lows in the second half of last year, consumer sentiment improved gradually in December and January with a welcome easing in inflation expectations. This indicator is more market-moving at turning points in the cycle, and unless we get big deviations today, it's unlikely to change much in terms of market pricing.

CENTRAL BANK SPEAKERS

- 09:00 GMT/04:00 ET - ECB's Kocher (neutral - voter)

- 11:00 GMT/06:00 ET - BoE's Pill (hawkish - voter)

- 17:00 GMT/12:00 ET - Fed's Jefferson (neutral - voter)