EUROPEAN SESSION

In the European session, the main highlights will be the BoE and ECB rate decisions. The Bank of England is expected to hold the Bank Rate steady at 3.75% with a 6-3 vote split (although there's also a strong consensus for a 7-2 split). The guidance in the statement will likely remain unchanged and the focus will be mainly on the MPR forecasts and individual members' views.

The ECB is expected to keep the policy rate unchanged at 2.00% and maintain it's data-dependent and meeting-by-meeting approach. The focus will be mainly on President Lagarde although she's not expected to give away much as they continue to just monitoring economic developments. There will certainly be questions about euro's strength and the currency could be impacted if Lagarde deviates from a neutral stance.

AMERICAN SESSION

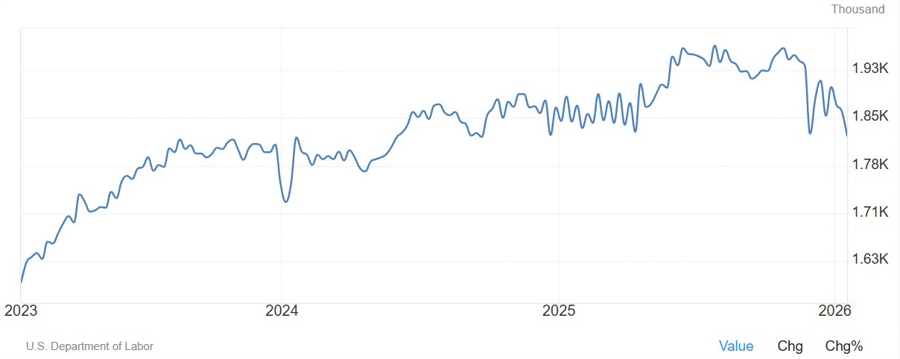

In the American session, the attention will switch to the US Jobless Claims and the US Job Openings data. Initial Claims are expected at 212K vs 209K prior, while Continuing Claims are seen at 1850K vs 1827K prior. There's been clear improvement in the Jobless Claims data that could suggest a pick up in labour market activity, although we will need to wait for the US NFP report next Wednesday to confirm that.

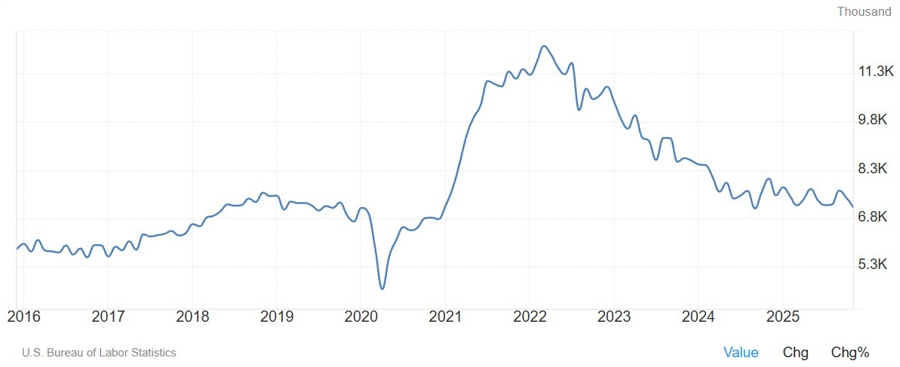

We will also get the US Job Openings data for December. This is a lagging indicator but gives some more details on the state of the labour market. Job Openings have been on a normalisation path after the surge in 2021 and have stabilised just a bit above the pre-pandemic levels. The consensus sees 7.250M openings in December vs 7.146M in November.

CENTRAL BANK SPEAKERS

- 15:50 GMT/10:50 ET - Fed's Bostic (hawkish - non voter)

- 17:40 GMT/12:40 ET - BoC Governor Macklem (neutral - voter)

- 22:30 GMT/17:30 ET - RBA Governor Bullock (hawkish - voter)