EUROPEAN SESSION

In the European session, we will get the final services PMI for the major Eurozone economies and the UK. The market reacts the most to new information, so the Flash data is more important than the final PMIs. Therefore, unless we get big deviations, the market reaction will likely be muted.

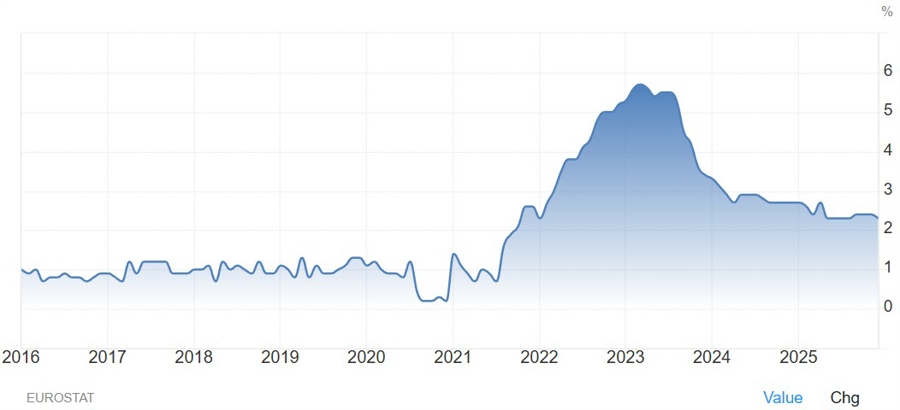

The main highlight will be the Flash Eurozone CPI. The CPI Y/Y is expected at 1.7% vs 1.9% prior, while the Core CPI Y/Y is seen at 2.3% vs 2.3% prior. As a reminder, the ECB has been repeating that they won't respond to small or short-term deviations from their 2% target, so unless we see big deviations, the data is not going to change much for the central bank.

AMERICAN SESSION

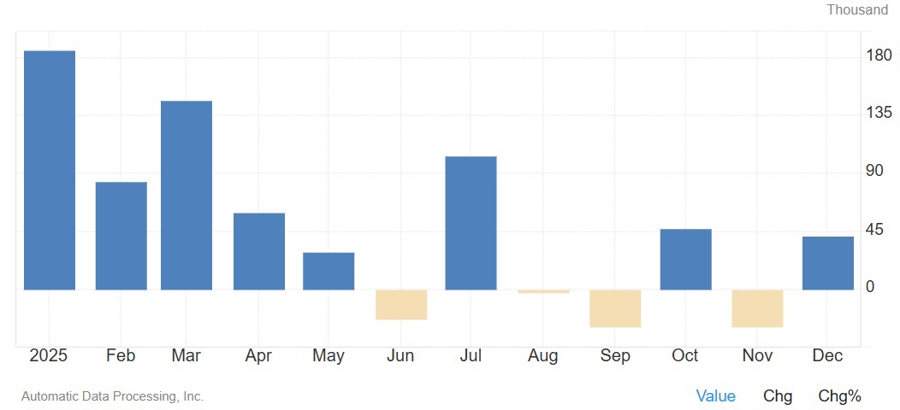

In the American session, the focus will turn to the US ADP and the US ISM Services PMI. The ADP is expected to show 48K jobs added in January vs 41K in December. The US data has been showing gradual improvement lately, especially on the labour market side. If we get a strong report, we could see a hawkish reaction in the market as the 48 bps of easing expected by year-end get repriced.

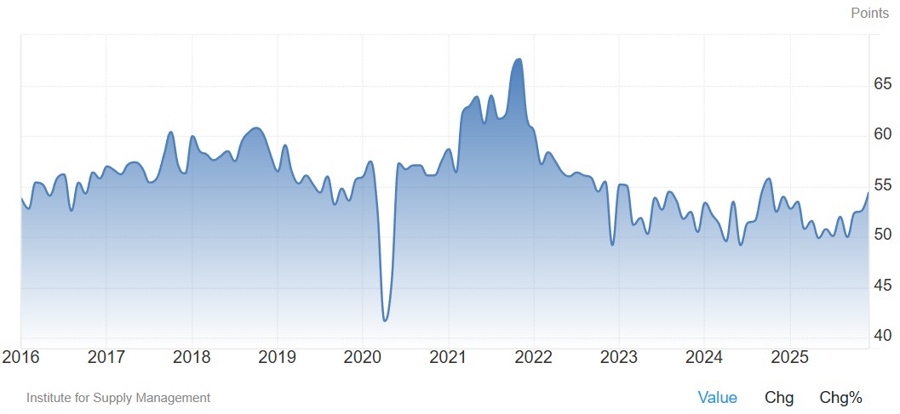

The US ISM Services PMI is expected at 53.5 vs 54.4 prior. The S&P Global US PMIs reaffirmed sustained economic growth at the start of the year, but the rate of expansion has cooled compared to the pace indicated back in the fall of 2025. The agency noted that jobs growth remains disappointing, with near stagnant payroll numbers. Lastly, elevated rates of input cost and selling price inflation were commonly attributed to tariffs, especially in the manufacturing sector, where price pressures intensified in January. However, service sector inflation moderated, linked in part to intensifying competition.

The ISM Manufacturing PMI on Monday though painted a different picture with the index jumping strongly into expansion for the first time since February 2025 and the new orders index rising to the best levels since 2022. The employment index has also showed material improvement, while the prices index held steady. A surprisingly strong ISM Services PMI could also trigger a hawkish reaction and lead to a repricing in interest rate expectations.

CENTRAL BANK SPEAKERS

- 17:00 GMT/12:00 ET - Fed's Barkin (hawkish - non voter)