EUROPEAN SESSION

In the European session, we will get the final PMIs for the UK and the major Eurozone economies. The market reacts the most to new information, so the Flash data is more important than the final PMIs. Therefore, unless we get big deviations, the market reaction will likely be muted. The data is also not going to change anything for the respective central banks.

AMERICAN SESSION

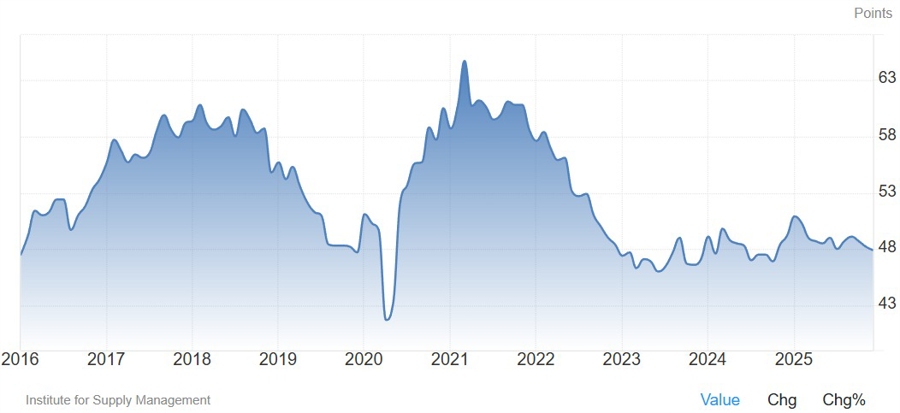

In the American session, the main highlight will be the US ISM Manufacturing PMI. The index is expected to tick higher to 48.5 vs 47.9 prior. The S&P Global US Manufacturing PMI rose a two-month high, with the agency noting that ouptut growth was the highest since last August, and new orders increased after falling in December. Employment growth meanwhile slipped to the lowest since last July and output prices increased.

This month could be pivotal for Fed's rate cuts expectations as we will get many top tier data points with the NFP and CPI being the main highlights. I mentioned how the latest selloff in the US Dollar wasn't backed by the fundamentals but more by "technical" things. The market is now pricing 55 bps of easing by year-end which could be wrong if we start to get stronger data.

In such a scenario, traders will trim their rate cut bets and the greenback will have the tailwind to erase last month's losses. If we get soft data, on the other hand, we can expect the dollar to remain on the backfoot although it's unlikely that we'll see the same momentum.

CENTRAL BANK SPEAKERS

- 11:45 GMT/06:45 ET - BoE's Breeden (dovish - voter)

- 17:30 GMT/12:30 ET - Fed's Bostic (hawkish - non voter)