EUROPEAN SESSION

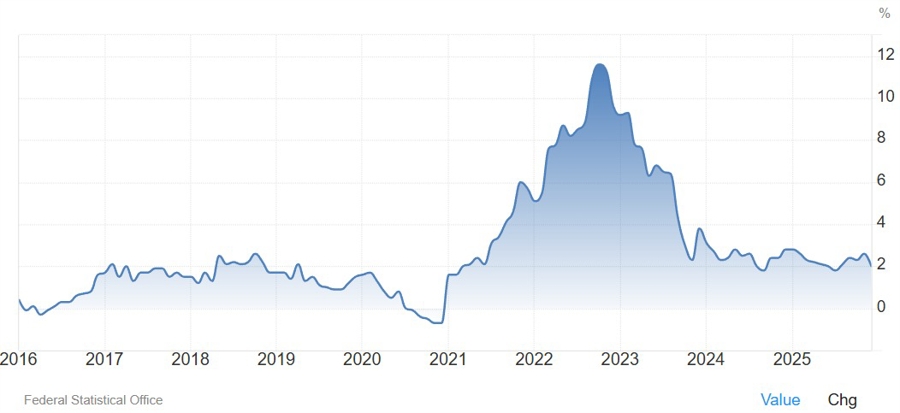

In the European session, we will get lots of tier one data points including GDP for France, Spain, Germany, Eurozone and CPI for Spain and Germany. The most important one will likely be the German inflation data as it's the most influential for the Eurozone CPI calculation and because inflation is what the ECB is most focused on. Euro's strength attracted the central bank's attention recently, so if we start to get soft inflation data, the market might start to price in a rate cut by year-end.

AMERICAN SESSION

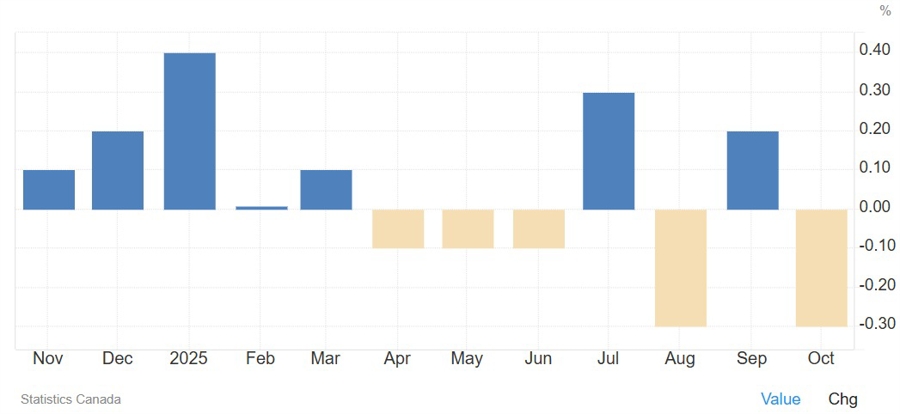

In the American session, the highlights include the Canadian monthly GDP, the US PPI report and Trump's Fed chair announcement. The Canadian GDP is expected at 0.1% vs -0.3% prior. The BoC has officially moved to a neutral stance as it changed their forward guidance to "the current policy rate remains appropriate" from "Governing Council sees the current policy rate at about the right level" prior. The monthly GDP data is not going to change anything at this point unless we see big deviations.

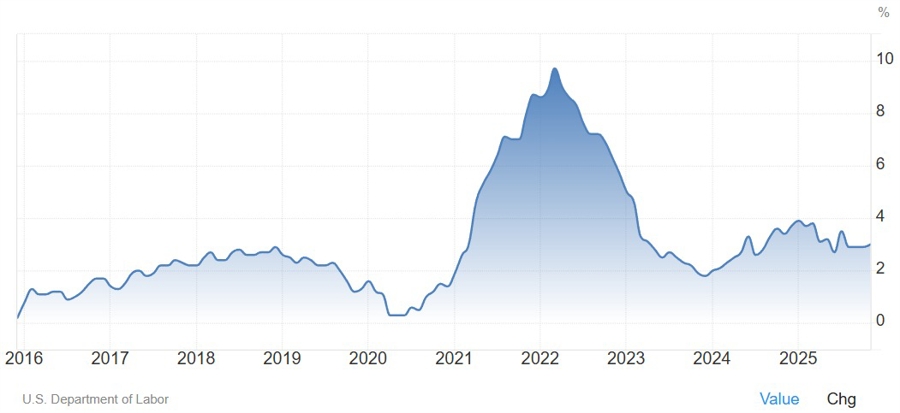

The US PPI Y/Y is expected at 2.8% vs 3.0% prior, while the Core PPI Y/Y is seen at 2.9% vs 3.0% prior. Forecasters can accurately estimate the PCE price index data based on the US CPI and PPI reports. Powell said that they expect the Core PCE Y/Y to be 3.0% in December. A soft PPI might change slightly those estimates, but it won't change anything for the near-term policy outlook.

Lastly, Trump is expected to announce his Fed chair pick today. Everything suggests it's going to be Kevin Warsh after reports that he was seen at the White House yesterday and after a couple of Trump's comments that indicate he's the most likely choice. We saw a hawkish reaction in the markets following the news tonight because Warsh was a hawk the last time he served at the Fed.

The historical stance is never a guarantee though. BoJ's Ueda was expected to be a hawk when he took the helm of the Bank of Japan and look how that turned out. Trump's decision though raises the probabilities of Powell staying on the board until 2028.

CENTRAL BANK SPEAKERS

- 18:30 GMT/13:30 ET - Fed's Musalem (hawkish - non voter)

- 22:00 GMT/17:00 ET - Fed's Bowman (dovish - voter)