EUROPEAN SESSION

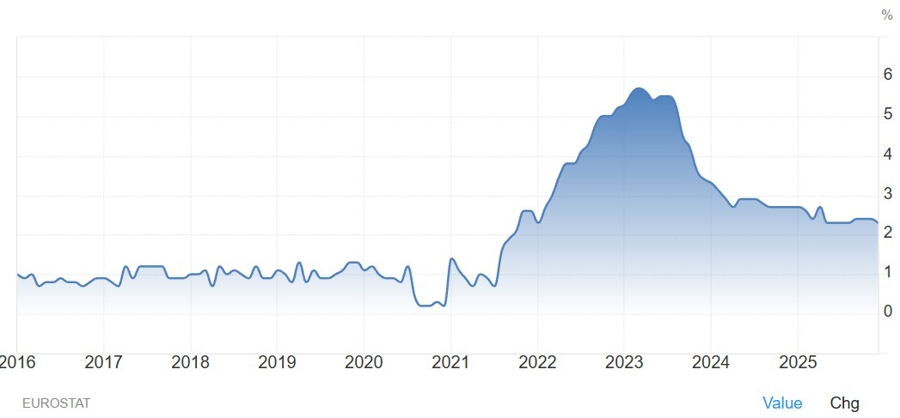

In the European session, we only have the final Eurozone CPI report. This is not a market-moving release given that the market pays more attention to the Flash report. It's rare to see big deviations from the preliminary numbers, so the reaction will likely be muted.

Today's session (and the next days really) will be all about the latest Trump's trade war against the UK, France, Germany and other European countries over Greenland. As a reminder, Trump announced that Denmark, Norway, Sweden, France, Germany, the United Kingdom, the Netherlands and Finland would face a 10% tariff from February 1, rising to 25% from June 1, unless the U.S. is permitted to buy Greenland.

The initial reaction was of course risk-off across the board. This kind of risk aversion will likely persist until we get some clear de-escalation, which might come in the second half of the week (potentially with a Truth Social post) as Trump and other leaders will be in Davos for the World Economic Forum (WEF).

AMERICAN SESSION

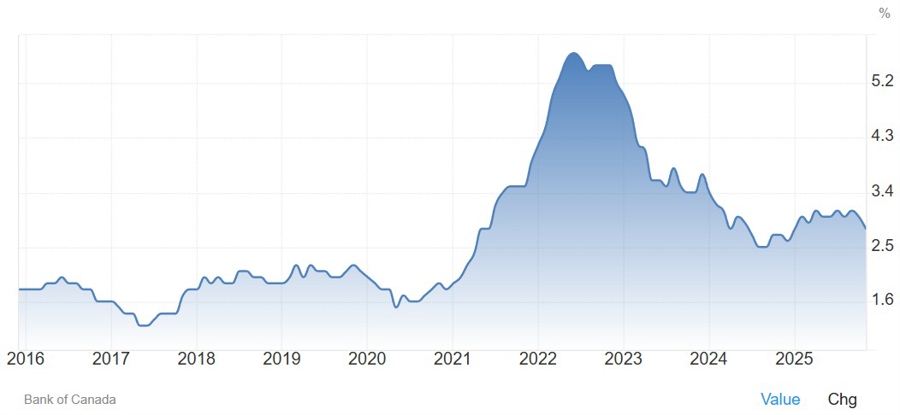

In the American session, the main highlight will be the Canadian CPI report. The BoC is focused mostly on underlying inflation, so the market's attention will be on the Trimmed Mean CPI Y/Y which is expected at 2.7% vs 2.8% prior.

As a reminder, following the blockbuster November's Canadian jobs report, the market fully priced in a rate hike from the BoC in 2026. At its policy meeting, the BoC didn't validate the market's bets highlighting the weaker details and repeating that underlying inflation was seen around target.

The last inflation report came out softer than expected and some of the hawkish bets were pared back with the market now seeing a total of 11 bps of tightening by year-end compared to 25 bps before the inflation data. Moreover, the last jobs report despite coming in better than expected, wasn't as strong as the prior one.

Lastly, it's worth noting that today is a US holiday with the US stock and bond markets closed.

CENTRAL BANK SPEAKERS

- 13:00 GMT/08:00 ET - ECB's Donnery (neutral - voter)