EUROPEAN SESSION

In the European session, we don't have anything on the agenda other than a couple of central bank speakers who are most likely going to repeat the same old stuff. In fact, ECB's de Guindos has been a broken record for months in reaffirming the central bank's neutral stance and the risks to both sides. BoE's Taylor is a known dove and he isn't going to deviate from his usual stance, especially since we haven't got any key UK economic data in January.

AMERICAN SESSION

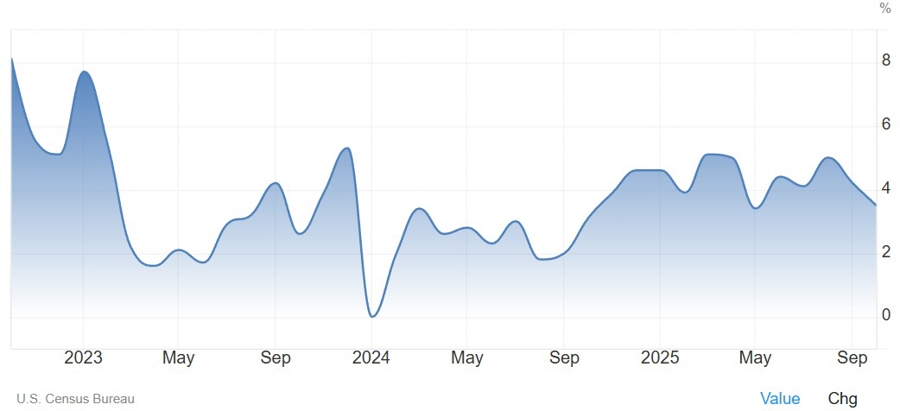

In the American session, we get the November US Retail Sales and PPI data, and we might have a US Supreme Court decision on Trump's tariffs. The US Retail Sales M/M is expected at 0.4% vs 0.0% prior, while the Ex-Autos M/M measure is seen at 0.4% vs 0.4% prior. The more important Control Group, which the BEA uses as the primary input for estimating the goods portion of consumer spending in its quarterly GDP reports, is expected at 0.4% vs 0.8% prior. Consumer spending has been resilient and just yesterday JPMorgan CEO Dimon confirmed that US consumer continue to spend.

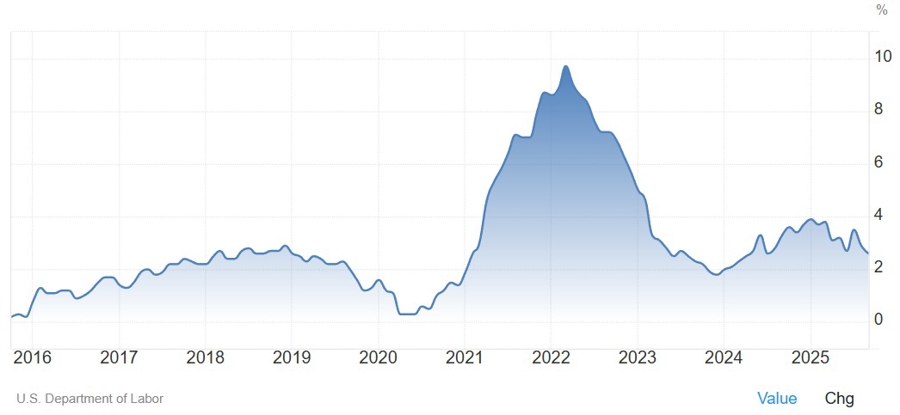

The US PPI Y/Y is expected at 2.7% vs 2.7% prior, while the M/M figure is seen at 0.2% vs 0.3% prior. The Core PPI Y/Y is expected at 2.7% vs 2.6% prior, while the M/M measure is seen at 0.2% vs 0.1% prior. With the PPI, the professional forecasters will be able to estimate the Fed's preferred measure of inflation, the PCE price index.

Overall, these releases might not matter much for the market both because it's old data (November) and because we just got the more important and more fresh NFP and CPI reports.

The main event might turn out to be the US Supreme Court today if they rule on Trump's tariffs. There's generally a 1-3 day "heads up" that a decision is coming but no indication of which cases will be decided. In fact, despite scheduling an "opinion day" for last Friday, the Supreme Court didn't rule on tariffs case. So, now we have to be ready anytime there's a decision day. Today is one of those days and the announcement is usually around 10 am ET.

.

Adam laid out potential trades on either decision here. If tariffs are struck down, the initial reaction will likely be pro-growth, so risk assets like stocks or commodities like copper are likely to surge. Precious metals might tumble on receding stagflation risks. Not sure if the reaction is going to be sustained though given that Trump's administration has already a plan to impose tariffs with other means. In case the Supreme Court keeps the tariffs in place, it shouldn't change anything, at the margin it could be positive for risk sentiment as it would eliminate a layer of uncertainty.

CENTRAL BANK SPEAKERS

- 08:00 GMT/03:00 ET - BoE's Taylor (dove - voter)

- 08:20 GMT/03:20 ET - ECB's de Guindos (neutral - voter)

- 09:15 GMT/04:15 ET - BoE's Taylor (dove - voter)

- 14:50 GMT/09:50 ET - Fed's Paulson (neutral - voter)

- 15:00 GMT/10:00 ET - Fed's Miran (uber dove - voter)

- 15:30 GMT/10:30 ET - BoE's Ramsden (dovish - voter)

- 17:00 GMT/12:00 ET - Fed's Bostic (hawkish - non voter)

- 17:00 GMT/12:00 ET - Fed's Kashkari (hawkish - non voter)

- 19:10 GMT/14:10 ET - Fed's Williams (neutral - voter)