EUROPEAN SESSION

In the European session, we don't have much on the agenda other than a couple of central bank speakers. The session will likely be characterised by a rangebound price action as the market awaits the US CPI release.

AMERICAN SESSION

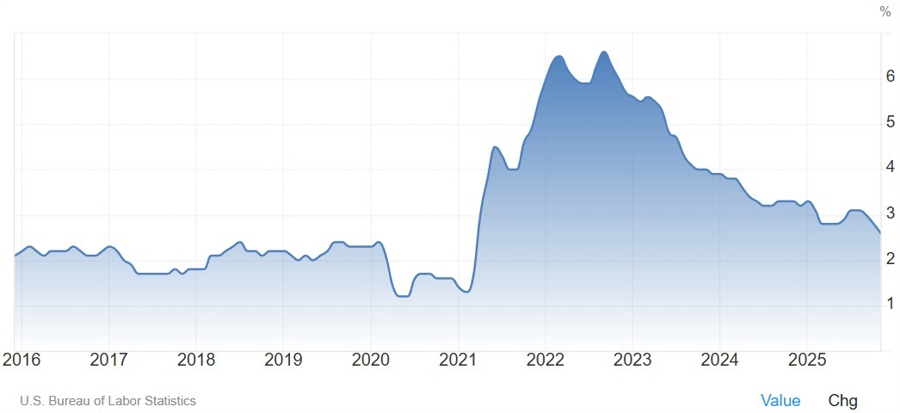

In the American session, we get the US NFIB Small Business Optimism Index and the weekly ADP data, but the main event of the day is going to be the US CPI report. Headline CPI Y/Y is expected at 2.7% vs 2.7% prior, while the M/M figure is seen at 0.3% vs 0.3% prior. The Core CPI Y/Y is expected at 2.7% vs 2.6% prior, while the M/M reading is seen at 0.3% vs 0.2% prior.

The Fed signalled a pause at the last policy decision by adding the line saying "in considering the extent and timing of additional adjustments to the target range for the federal funds rate, the Committee will carefully assess incoming data, the evolving outlook, and the balance of risks".

As a reminder, the Fed projected just one rate cut this year, while the market is still betting on two, with the first one expected in June. The latest NFP report saw the unemployment rate falling to 4.4% vs 4.6% prior. The data was overall good and reaffirmed the Fed's patient stance.

Barring another notable weakening in the labour market, inflation data is what is going to determine the extent of Fed's policy easing this year, so it should be more important for the market. In the bigger picture, the Fed's reaction function remains dovish, so we would need strong reasons for them to considering rate hikes. For now, the worst case scenario is that they hold rates higher for longer.

CENTRAL BANK SPEAKERS

- 09:00 GMT/04:00 ET - BoE's Governor Bailey (neutral - voter)

- 09:40 GMT/04:40 ET - ECB's Kocher (neutral - voter)

- 15:00 GMT/10:00 ET - Fed's Musalem (hawkish - non voter)

- 21:00 GMT/16:00 ET - Fed's Barkin (hawkish - non voter)