EUROPEAN SESSION

In the European session, we the main highlights are the Swiss Unemployment Rate and the Eurozone Retail Sales data. These releases won't change anything for the respective central banks, so the market reaction will likely be muted. Traders will also tread carefully into the American session where we will get the most important releases of the day.

AMERICAN SESSION

In the American session, all eyes will be on the US NFP report but we will also get the Canadian jobs data at the same time, and a potential US Supreme Court decision on Trump's tariffs a couple of hours later.

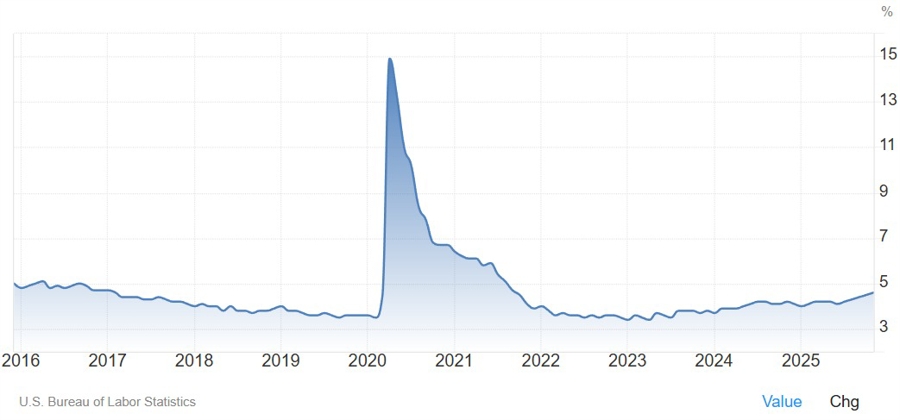

The NFP is expected to show 60K jobs added in December vs 64K in November, with the Unemployment Rate ticking lower to 4.5% vs 4.6% in the prior month. The Average Hourly Earnings Y/Y are expected at 3.6% vs 3.5% prior, while the M/M figure is seen at 0.3% vs 0.1% prior.

The market is expecting the Fed to cut twice this year with the first fully priced in cut in June. There's a 13% probability of a rate cut at the upcoming meeting, so we will need very soft NFP and CPI reports to force the Fed to cut so soon. Nevertheless, even if the Fed doesn't cut in January, soft data should bring rate cut expectations forward or increase the probabilities for a third one and thus pressure the US dollar. On the other hand, strong data will likely weigh on the total easing expected for 2026 and give the US dollar a boost.

I have a feeling that CPI will be more important because inflation worry is what is constraining the Fed from acting more quickly and with more conviction on rate cuts. Nonetheless, notable deviations in the NFP report will still trigger big market moves and influence the market pricing.

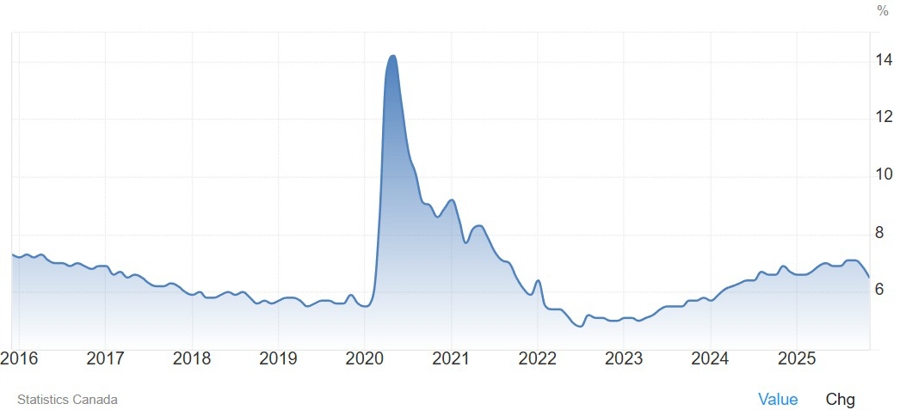

The Canadian employment report is expected to show -5K jobs cut in December vs 53.6K jobs added in November, with the Unemployment Rate ticking higher to 6.6% vs 6.5% prior. We've got a series of very strong employment reports from Canada in the last part of 2025 which led the market to price in rate hikes in 2026. The softer than expected Canadian inflation data helped to ease those expectations but another strong report might bring them back quickly.

Lastly, the US Supreme Court scheduled today as an "opinion day" and from 10:00 am ET onwards we could potentially get a decision on Trump's tariffs. In case the tariffs are struck down, the initial market reaction will likely be positive on expected better global growth. On the other hand, if tariffs are left in place it shouldn't change much given that the market has already adapted and it might even be a positive outcome as it would remove the uncertainty of a change in tariff policy.