EUROPEAN SESSION

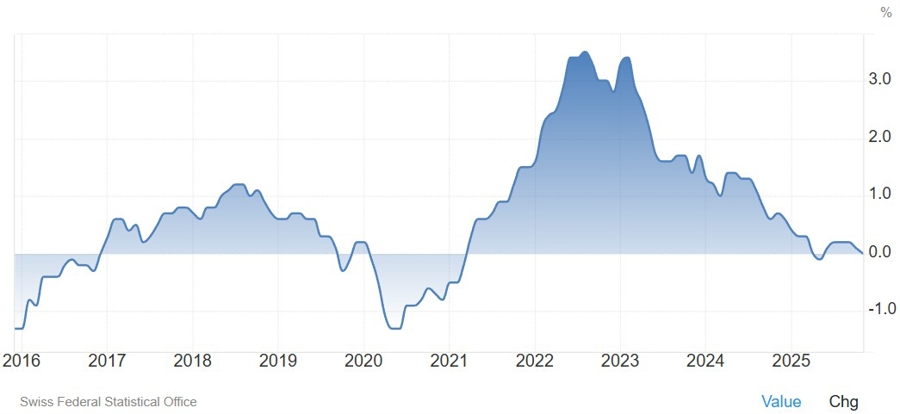

In the European session, we have a few important data releases although they most likely won't be market-moving given the limited impact on monetary policy. The Swiss CPI Y/Y is expected at 0.1% vs 0.0% prior. Inflation has been missing the SNB's forecasts recently but the central bank continues to push back on negative interest rates and maintains a positive outlook. The data won't change anything for the SNB unless we start to see bigger downside surprises.

The Eurozone unemployment rate is expected to remain unchanged at 6.4%. It has increased a little bit in 2025 but remains near record lows. If the rate continues to increase, the market will likely start to price in good chances of a rate cut in the second half of 2026, especially if inflation keeps on easing.

AMERICAN SESSION

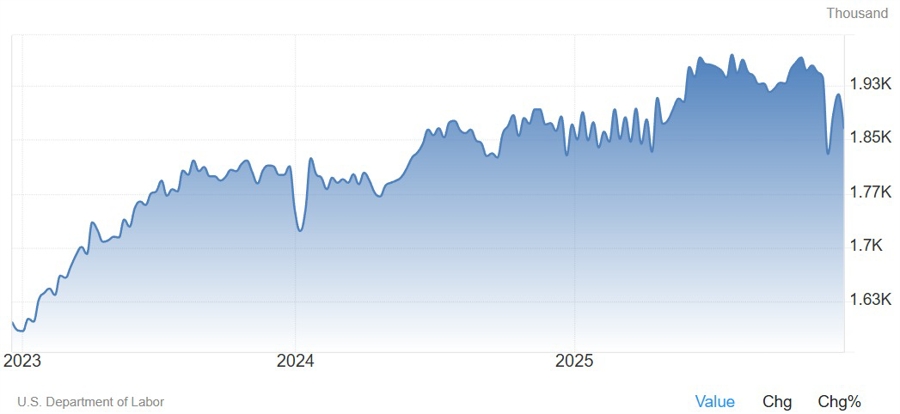

In the American session, the main highlight will be the US Jobless Claims data release. Initial Claims are expected at 210K vs 199K prior, while Continuing Claims are seen at 1900K vs 1866K prior. Jobless Claims have been the clearest proof of the "low firing, low hiring" labour market as initial claims remained contained in the range created since 2022, while continuing claims kept on creeping up, especially after "Liberation Day" as economic uncertainty increased.

We saw a notable drop in continuing claims recently but we've also had lots of holidays that might have skewed the data. The NFP report tomorrow should give us a better view of the current labour market conditions.