EUROPEAN SESSION

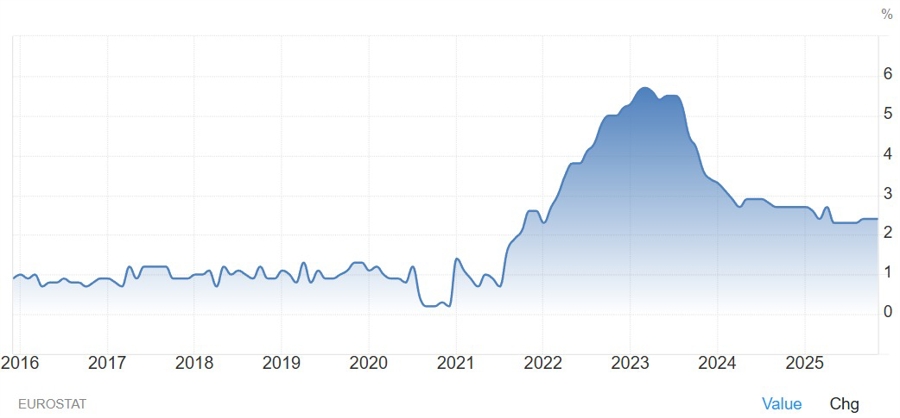

In the European session, the main highlight is going to be the Eurozone Flash CPI report. Headline CPI Y/Y is expected at 2.0% vs 2.1% prior, while the Core CPI Y/Y is seen at 2.4% vs 2.4% prior. Yesterday, we got some soft figures out of France and especially Germany. The expectations are likely skewed to the downside.

In terms of monetary policy, the data is not going to change anything for the ECB as the central bank remains comfortably on the sidelines. ECB members repeated many times that they won't respond to small or short-term deviations from their 2% target and the next policy move could be in either direction. The market pricing shows a strong consensus for the ECB to remain on hold for the entire year.

AMERICAN SESSION

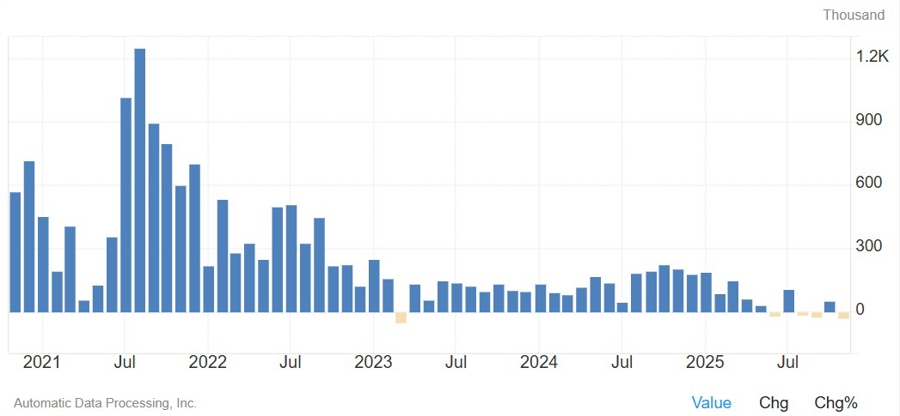

In the American session, we get a few top tier US economic releases. The US ADP is expected at 47K vs -32K prior. The ADP has been on a weak streak since last June. We haven't seen so many negative monthly figures since 2020. The consensus is still for a "low firing, low hiring" labour market as shown also by the stable jobless claims data, but as Fed's Kashkari pointed out recently, there's also a risk that the unemployment rate could spike.

The US ISM Services PMI is expected at 52.3 vs 52.6 prior. The S&P Global US Services PMI showed business activity weakening in December although remaining in expansion. The more worrying part was that input costs and selling prices "increased sharply". The Fed is trying to balance a weaker labour market with above target inflation, and if these two continue to diverge, it's going to be tricky for monetary policy.

The US Job Openings are expected at 7.600M vs 7.670M. The prior report beat expectations by a big margin but the quits rate fell to the lowest level since 2020. Quits typically rise when workers feel confident they can easily find another job. The decline signals a weak labour market under the surface.