EUROPEAN SESSION

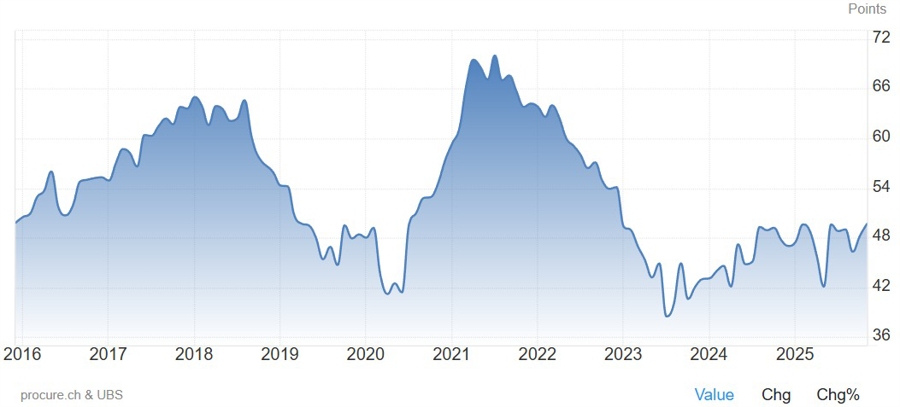

In the European session, we don't have much on the agenda other than a couple of low tier releases. The Swiss Manufacturing PMI is expected at 49.6 vs 49.7 prior, but whatever the data shows, the SNB is not going to do anything in terms of monetary policy. The same goes for the Swiss Retail Sales data which is expected at 3.0% for the Y/Y figure.

The Eurozone Sentix index is expected -5.0 vs -6.2 prior. The ECB is comfortably in a neutral stance with policy decisions taken on a meeting-by-meeting basis and data dependent approach. The central bank has repeatedly stated that it won't respond to small or short-term deviations from the 2% target unless there's a clear shock in the economy.

AMERICAN SESSION

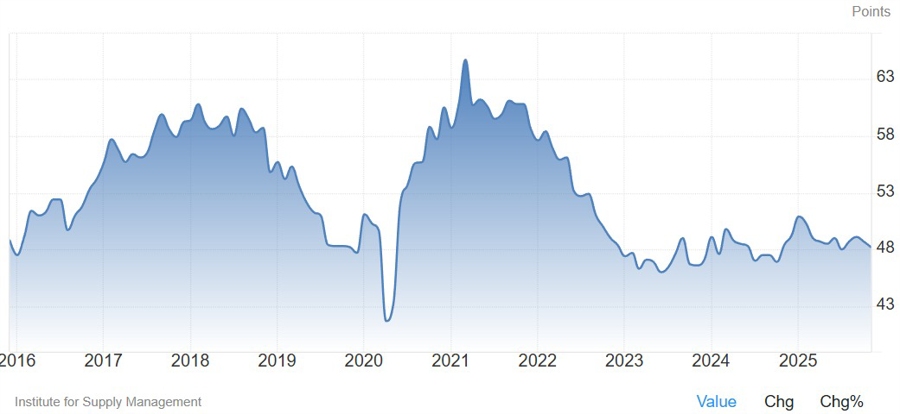

In the American session, the only highlight is the US ISM Manufacturing PMI. The index is expected at 48.3 vs 48.2 prior. It's been falling for three consecutive months and the commentary, despite being mixed, leant on a more weaker side.

The latest S&P Global US Manufacturing PMI showed that this softer trend persisted in December with the agency noting "weaker gain in production, amid a renewed contraction in new order books (the first in exactly a year)", and added that "international sales continued to fall, in part linked to tariffs, which also continued to push up operating expenses at an elevated pace." On the inflation side, although remaining historically elevated, "both input and output prices rose at their slowest rates for 11 months".