In the European session, we have the Swiss National Bank (SNB) releasing its monetary policy decision. The central bank is widely expected to keep interest rates unchanged at 0.00% and not signal anything in terms of forward guidance. Despite the disappointing inflation data in the recent months, SNB members reiterated that the bar for negative rates remains very high.

They just don't want to go back into NIRP (Negative Interest Rate Policy) without a very strong reason, that at this point looks like a global recession or some outright deflation in Switzerland. SNB's Chairman Schlegel said that they expect inflation to pick up a bit in the next months.

Switzerland has also reached a deal with the US to lower the 39% tariffs on Swiss goods to 15%. That should be positive for the Swiss economy and potentially give it a little boost.

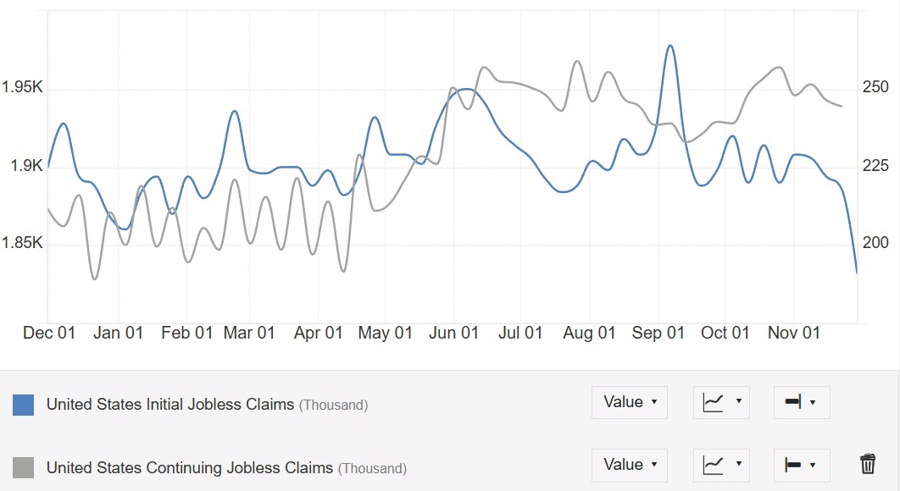

In the American session, the main highlight will be the release of the US Jobless Claims figures. Initial Claims are expected at 220K vs 191K prior, while Continuing Claims are seen at 1947K vs 1939K prior.

The data has been pointing to a "low firing, low hiring" labour market for a very long time, and as Fed Chair Powell said yesterday, that's an unusual situation. The Fed is trying to help the demand side and turn it more into a "low firing, higher hiring" labour market without stoking inflation.

Central bank speakers:

- 09:00 GMT/04:00 ET - SNB Press Conference

- 10:00 GMT/05:00 ET - BoE's Bailey (neutral - voter)