In the European session we have just a few low tier indicators that won't influence interest rates expectations. The focus today is of course on the US NFP report but there's also the Canadian employment data being released at the same time. We then conclude with the University of Michigan Consumer Sentiment.

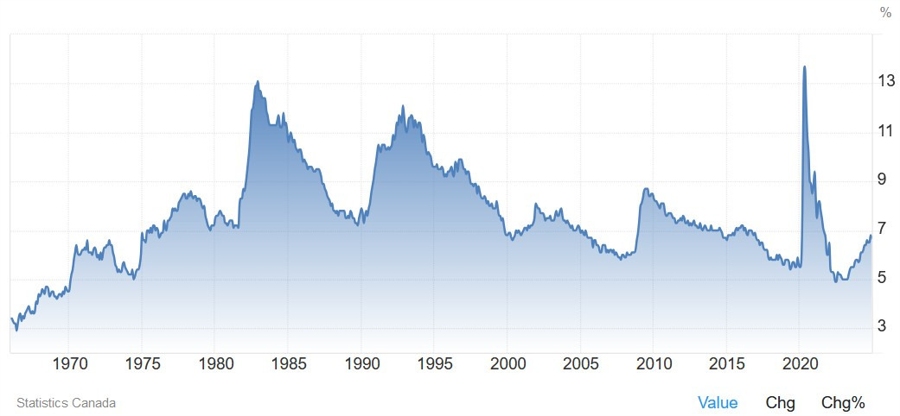

13:30 GMT/08:30 ET - Canada January Employment report

The Canadian Employment report is expected to show 25K jobs added in January vs. 90.9K in December and the Unemployment Rate to tick higher to 6.8% vs. 6.7% prior. The last report was really strong with wage growth easing further. The data from Canada has been pointing to gradual improvement after the aggressive rate cuts which would have likely seen the CAD being supported if it wasn’t for Trump’s tariffs threats. Now that those tariffs fears have eased, will we get a sustained break below the key 1.4280 level in USD/CAD?

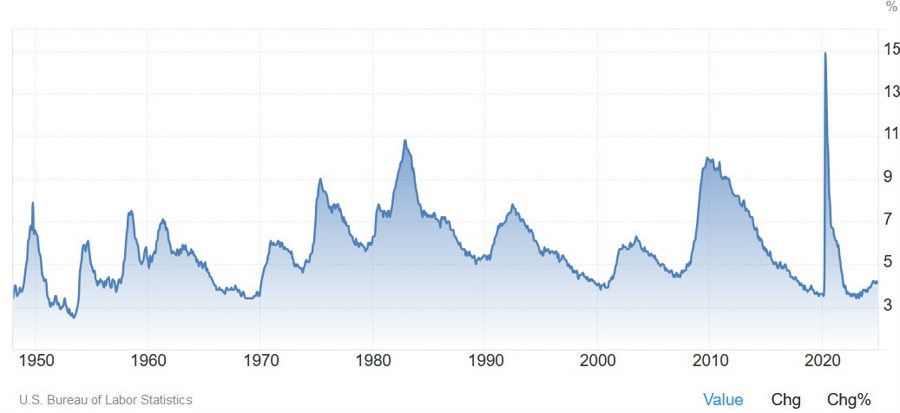

13:30 GMT/08:30 ET - US January Non-Farm Payrolls

The US NFP is expected to show 170K jobs added in January vs. 256K in December and the Unemployment Rate to remain unchanged at 4.1%. The Average Hourly Earnings Y/Y is expected at 3.8% vs. 3.9% prior, while the M/M figure is seen at 0.3% vs. 0.3% prior.

The last report came out much stronger than expected and led to another hawkish repricing in interest rates expectations, although eventually it marked the top as we got benign US inflation data the following week.

The Fed is mainly focused on inflation now given that the labour market remains solid but it’s not a source of inflation pressures given the easing wage growth and a low quits rate. The data we got up to now points to another strong employment report, so even if it's bad it will likely be taken as just a blip.

Central bank speakers:

- 08:45 GMT - ECB's de Guindos (dove - voter)

- 12:15 GMT/07:15 ET - BoE's Pill (neutral - voter)

- 14:25 GMT/09:25 ET - Fed's Bowman (hawk - voter)

- 17:00 GMT/12:00 ET - Fed's Kugler (dove - voter)

- 20:00 GMT/15:00 ET - ECB's Escriva (dove - voter)