We don't have much in the European session today as we just get a couple of low tier indicators that are unlikely to influence markets expectations. The main highlights will be the BoE rate decision and the US Jobless Claims at the beginning of the American session.

12:00 GMT/07:00 ET - Bank of England Policy Decision

The Bank of England is expected to cut interest rates by 25 bps bringing the Bank Rate to 4.5% with a 8-1 vote split. As a reminder, the BoE kept the Bank Rate unchanged as expected at the last policy decision but we got a more dovish than expected vote split as 3 voters wanted a rate cut compared to just 1 expected.

Policymakers continue to lean towards four rate cuts for this year compared to three rate cuts expected by the market. The recent UK PMIs showed all the indices jumping to a three-month high although the S&P Global noted that companies have been cutting employment amid falling sales and that price pressures reignited pointing to a stagflationary scenario. It added that although output ticked higher, it's an economy that is broadly flatlining with risks remaining skewed to the downside.

13:30 GMT/08:30 ET - US Jobless Claims

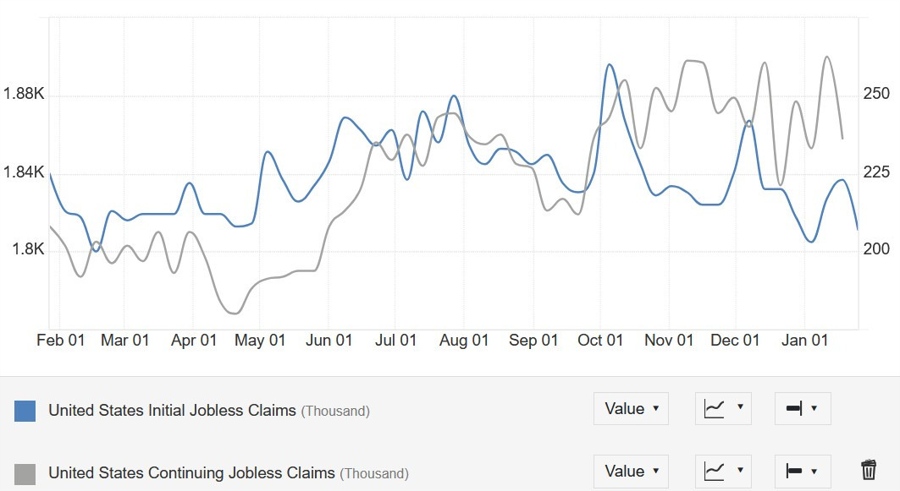

The US Jobless Claims continue to be one of the most important releases to follow every week as it’s a timelier indicator on the state of the labour market.

Initial Claims remain inside the 200K-260K range created since 2022, while Continuing Claims continue to hover around cycle highs although we’ve seen some easing recently.

This week Initial Claims are expected at 213K vs. 207K prior, while Continuing Claims are seen at 1874K vs 1858K prior.