Today there are high chances of having a "risk-on" day after yesterday's positive Mexican and Canadian tariffs news. In fact, after Colombia, Mexico and Canada, the market is now likely to fade any tariffs news in expectations of a quick delay or some kind of a deal.

This morning China promised to retaliate with tariffs ranging from 10% to 15% on certain US imports and going into effect the 10th of February. There's plenty of time for talks and we've already got news of a Trump-Xi call coming soon.

The tariffs news continue to be at the centre stage given the broad macroeconomic impact, so the economic data has been kind of ignored recently. Nonetheless, today we get the US Job Openings and the New Zealand Employment report with the latter likely having a bigger influence on interest rate expectations for the RBNZ.

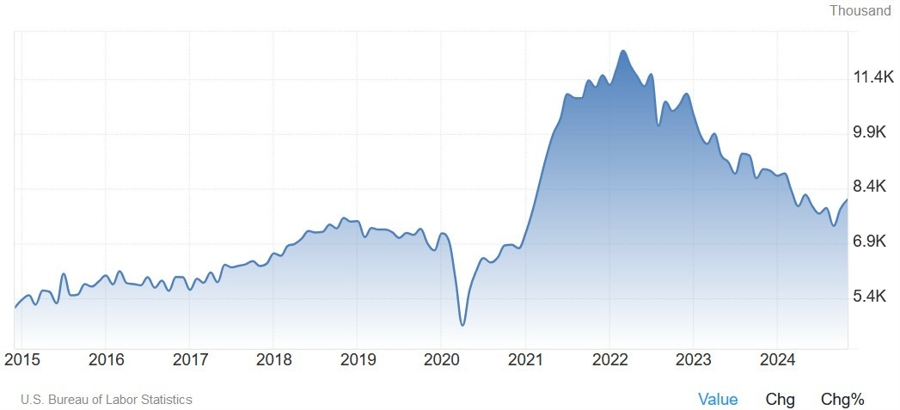

15:00 GMT/10:00 ET - US December Job Openings

The US Job Openings are expected at 8.000M vs. 8.098M. The last report surprised to the upside as rate cuts and Trump’s victory boosted business confidence and activity. Overall, the data continues to point to a solid labour market although the low quits and hiring rates suggest that it might be hard to get a job but there’s also less chance of losing one.

21:45 GMT/16:45 ET - New Zealand Q4 Employment report

The New Zealand Q4 Employment change Q/Q is expected at -0.2% vs. -0.5% prior, while the Unemployment Rate is seen increasing further to 5.1% vs. 4.8% prior. The Labour Cost Index Y/Y is expected to ease to 3.0% vs. 3.4% prior, while the Q/Q rate is seen at 0.6% vs. 0.6% prior.

The RBNZ got inflation back within the target band and it’s now focusing on growth much like the Bank of Canada. The market expects another 50 bps cut at the upcoming meeting and a total of 120 bps of easing by year end.

Central bank speakers:

- 16:00 GMT/11:00 ET - Fed's Bostic (non voter - neutral)

- 19:00 GMT/14:00 - Fed's Daly (non voter - neutral)